What Is Cash Burn Rate? How Cash Burn Rate is Key to Sustainability

Posted By

Do you know how much cash you have on hand? How about how much cash you used last month? Last quarter? Are you aware of how much cash you’ll have left after this month?

If you don’t have quick answers to these questions, you’re putting your business at risk. Cash is the lifeblood of a business and knowing your position and usage is vital for maintaining a healthy business. Sure, your business may be profitable on paper, but without enough cash to support expenses, you can still find yourself on the verge of closing down.

Now don’t worry, there are a few simple ways to look into and keep track of your cash flow. We’re talking about your cash burn rate and cash runway.

What is cash burn rate?

The cash burn rate is the rate at which a company uses up its cash reserves or cash balance. Essentially, it’s a measure of negative cash flow, typically recorded as a monthly rate. For example, if you list your cash burn rate as $250,000 then you are stating that in a given month your business is spending $250,000. It can also be observed on a day-by-day or weekly basis if a crisis occurs and cash usage increases in order to keep your business afloat.

Why is cash burn rate important?

When you’re thinking about cash burn rate, you’re asking:

- How fast am I using up my cash reserves?

- Is my cash moving in a positive direction?

- Am I building up a healthy balance from positive cash flow?

- How long until I run out of cash based on my current rate of spending?

Generally, you start with these questions to help determine the overall health of your business. How much cash you have available to cover necessary expenses, pay off debt, and leverage for purchases aimed toward growth. In short, you’re looking to keep track of how sustainable your business is so that you aren’t surprised by a sudden lack of cash in the bank. A good rule of thumb when looking at cash flow is that if a business is burning cash too quickly, it risks going out of business. On the opposite side, if a business burns cash too slowly it may showcase growth stagnation or a lack of investment toward the future.

The cash burn rate is especially important for startups and small businesses in the early stages of growth. More often than not, businesses just starting out aren’t profitable yet, particularly in high-growth technical industries. It may take a few months to a few years to achieve profitability, meaning that you’ll need to keep a close eye on your cash and funding to manage expenses.

Now, the burn rate is still important for businesses that have achieved profitability. It’s vital for crisis planning, helping you identify sales and revenue issues, and proving your position when seeking out additional funding. In all of these situations, having a handle on your current situation, knowing how you use cash, and being able to make adjustments are all key for driving business growth.

How do you calculate cash burn rate?

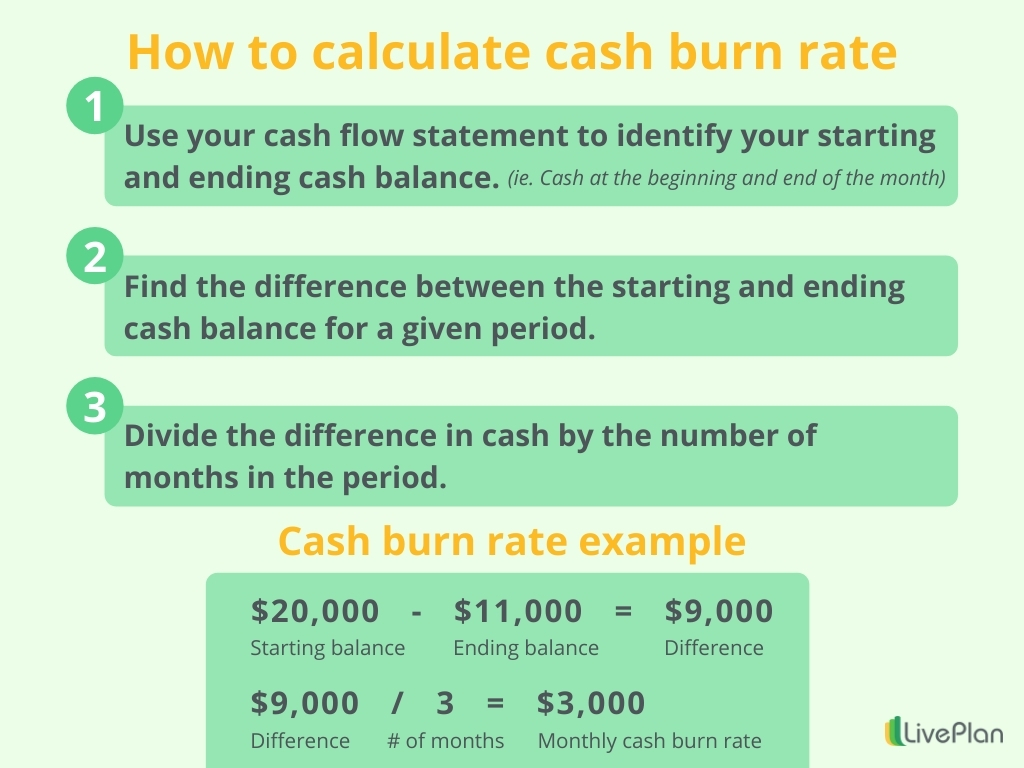

To calculate your cash burn rate, you’ll need to pull up your cash flow statement. This will showcase your cash position at the beginning and end of a given period of time, typically monthly. Here’s how to use your statement to calculate your cash burn rate.

Current Burn Rate = Cash Balance in Prior Month – Cash Balance in Current Month

To determine the burn rate for a selected period, you find the difference between the starting and ending cash balances for the period of time— say a quarter. Then divide that total by the number of months in the selected period. The result is a monthly value.

Monthly Burn Rate = (Cash Balance Beginning of Period – Cash Balance End of Period) / # of Months in Period

Cash burn rate example

For example, say a company started last quarter with $200K in the bank but ended with only $110K. That’s a loss of $90K in cash over three months—a burn rate of $30K per month.

From a cash runway perspective, that suggests that the company now has just over three months of cash runway or cash on hand. They need to lower their burn rate and get cash flow positive soon. If it’s helpful to see an example of a cash flow statement at this point, you can download our free cash flow example PDF or spreadsheet.

Now that you know your cash burn rate, you can see how long the current burn rate is sustainable. By calculating your cash runway.

What is a cash runway?

Your cash runway is how long your cash will last at your current cash burn rate. When your cash runway runs out, you’re out of cash and you’re out of time.

The typical pattern for startups is to get funded, use that cash to build the business, and then aim to get to positive cash flow before the money runs out. It’s a big concern for funded startup companies—particularly if you’re working with venture capital or angel investment.

The same metric is useful for mature businesses too. How fast are you growing your cash reserve? Are you strategically investing that money to fund faster growth? Whatever your plans, be sure to keep an eye on this metric to make sure you are hitting your targets.

How do you calculate cash runway?

Finding your cash runway is reliant on you knowing your monthly cash burn rate. Other than that, all you need to know is the total cash you have in reserves. To calculate your cash runway, use the following equation.

Cash Runway = Total Cash Reserve / Burn Rate

To figure out your cash runway (how long the company has until it runs out of cash), take the rest of the money left in the cash reserves and divide it by the burn rate. For example, if there is $200,000 left and the burn rate is $50,000 per month, it will take 4 months for the company to run out of cash.

Is high or low cash burn rate better?

It’s often best to have a negative cash burn rate. That means you are building your cash reserves, not using them up. There are certainly cases where investing your cash in growth is a good idea, though: startups, obviously, but also bootstrapped companies that are trying to grow. Just make sure you plan for that cash burn and then track your progress.

If you burn through your cash reserves faster than expected, you may end up in trouble.

How do you reduce your cash burn rate?

If your cash burn rate is higher than you want, the numbers to change are pretty simple. You need to increase your incoming cash, decrease your outgoing cash, or both. Here are ideas on how to do those things:

1. Increase your revenue

Look for ways to boost your traffic, get more prospects into your pipeline, increase your conversion or close rates, or raise your pricing. More sales should translate into more cash coming in.

2. Reduce your payroll expenses

For labor-intensive businesses, deferring new hires, laying off nonessential workers, or limiting benefits can lead to big savings. Make sure any cuts are smart and sustainable, though.

3. Reduce your direct costs

For low-margin businesses, finding ways to minimize unnecessary inventory of raw materials and other direct costs can make a big difference in cash flow.

4. Reduce or defer other expenses

Take a close look at your budget. Are there expenses that aren’t contributing to your company’s success?

5. Ditch unprofitable revenue streams

It’s not uncommon for businesses, who are looking to grow, to offer secondary products or services that don’t break even. Put any non-revenue generating offerings on hold to help regulate your Cash Burn Rate. You can always relaunch at a later time.

6. Encourage cash sales

Cash sales are great: you get the money right away instead of waiting for it. Make sure you are offering credit terms selectively and smartly, rather than just converting what would have been immediate transactions into delayed ones.

7. Bill sooner and collect faster

When you do offer credit to customers, be sure to bill them promptly. Clearly state the credit terms and follow up with appropriate collection activities if they don’t pay on time. Adding late-payment charges may also help more timely payments.

8. Pay your bills slowly

Unless there’s a discount or other incentive for paying sooner, don’t pay your bills any faster than you have to. Take advantage of the agreed payment terms to hold onto your cash longer.

9. Sell off excess inventory

Extra inventory is still valuable, but it’s not as useful as having the equivalent amount of cash. Consider offering sales promotions or discounts to sell off what you don’t need for regular sales.

10. Consider using a factoring service

Factoring is a financial service in which a business sells off its bills receivable to a third party at a discounted rate. If you cannot get customers to pay their invoices on time, it may be worth looking into such a service.

11. Hold off on major purchases

If cash is tight, that big capital expenditure may need to wait—unless it’s an investment that will start paying off right away.

12. Consider refinancing debts

Using too much cash to repay debts? Check with your creditors about options to refinance with lower payments.

13. Raise additional funds

If you’ve done all you can to affect your incoming and outgoing cash (your cash flow), but your burn rate is still too high—and, crucially, you are confident that your business can be successful—you may need to do more fundraising. Be sure to do this as early in the process as possible, since a business running low on cash may strike potential lenders as too risky.

Where to find your burn rate in LivePlan

If you’re exploring software options that can help you better manage your cash flow, you may want to check out LivePlan. With it, you can easily keep track of your financials, bring forecasts up to date and easily review your cash burn rate starting with a cohesive view of every metric in your business dashboard. Here’s how to look into your cash bur rate in LivePlan.

Once you’ve logged in to your LivePlan account and are looking at the Dashboard, click into the “trends” option in the navigation. Click the current metric (likely Revenue) to bring down the menu and select the cash burn rate under the Cash Metrics category. This will give you a visual and statistical overview of your cash burn rate in a given time period, with the option to adjust which periods you want to view.

The benefit of using LivePlan, aside from knowing your burn rate, is that it also tells you how your burn rate is performing compared to the previous period, year, and your forecast. This makes it easier to review if you’re making positive progress in optimizing your burn rate or if you need to make further adjustments.

Keep an eye on your cash flow

The cash burn rate and cash runway are relatively simple formulas, but they’re vital to build and maintain your business. The better you are at managing your cash and understanding your overall position, the more prepared you’ll be to pursue growth or handle a crisis. For more business concepts made simple, check out these articles on direct costs, net profit, operating margin, accounts payable, accounts receivable, cash flow, profit and loss statement, balance sheet, and expense budgeting.

Editor’s note: This article was originally published in 2019 and updated for 2021.