How to Build a Business Model

Posted By

Defining your business model is the last step in creating a one-page plan.

To help you write, download our free template or signup for LivePlan and then follow along to create a simple, one-page business plan that will grow your business.

Even if you’re not building a one-page plan, this article series will help you develop your business strategy, develop tactics to support your strategy, create a roadmap to grow your business, and define your business model.

In this final step, you’ll build out your business model.

What is a business model?

A business model is the description of how your business is going to make money. Your business model describes where your revenue comes from and what your key expenses are.

Most business models are fairly straightforward: your company sells a product or service to your customers and you have a budget to cover your expenses. To be a profitable business, your income just needs to be greater than your expenses.

Other business models can be more complex.

Take Google, for example. They give away their primary product (internet search) for free and charge advertisers to put ads on those search results. In this business model, Google has two customers: people who search and advertisers who buy ads. Google needs to please both of them to make their business work. Granted, this is a massive over-simplification of Google’s business model, but hopefully, you get the idea.

Start by describing your business model—skip the numbers

When you’re defining the business model for your business, you can initially skip doing a detailed financial forecast.

Skipping this step makes planning faster, easier, and helps you focus on what matters most—your strategy. If you don’t have a product or service that customers want and a solid business model, having a detailed financial forecast won’t matter.

So, focus on making sure you have a solid business model first. You’ll get to the detailed financial forecasts later.

Start out by just describing your business model: Where does your revenue come from? If you sell different types of products and services, list them. Next, list out your key expenses. You don’t need to know exactly how much the expenses will be, just a list of what they are.

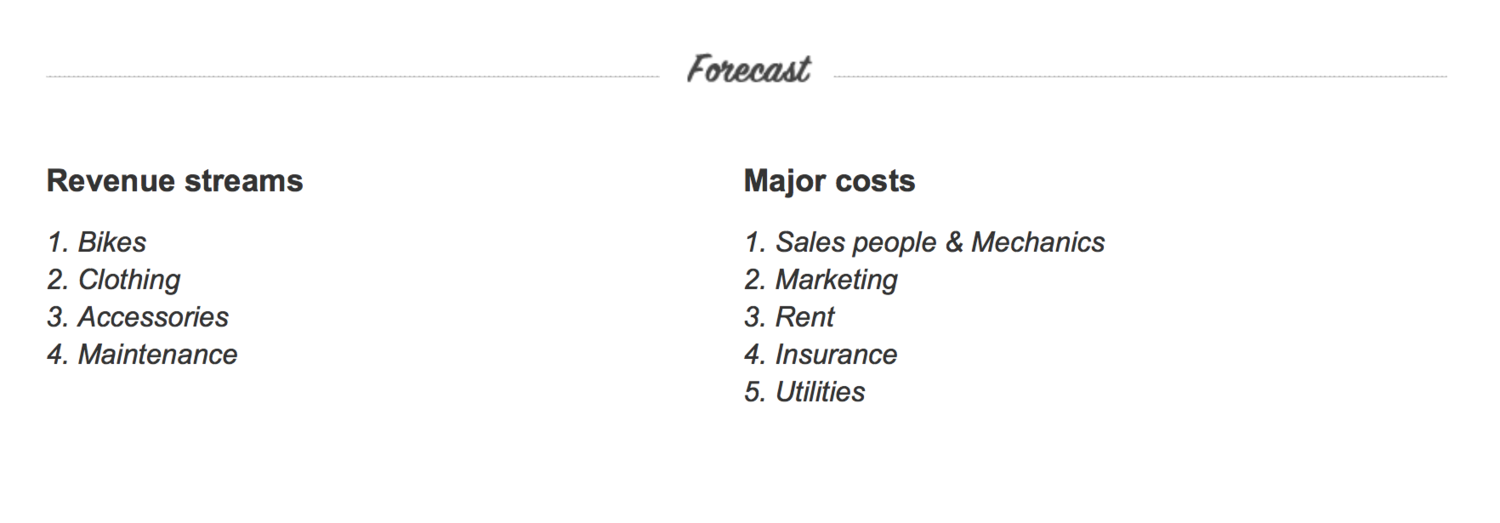

Using Garrett’s Bike Shop as an example, we might list out revenue streams for bikes, clothing, accessories, and bike maintenance. Garrett would have an expense list that would include salaries for employees, rent, marketing, utilities, and insurance.

The goal at this stage is just to document how your business works. You want to do this as quickly as possible while you spend time figuring out your business strategy.

Creating a financial forecast for your business model

When you’re ready and you’ve validated that your prospective customers are interested in your business idea, then it’s time to move on to create a more detailed business model.

This time, you’ll want to actually figure out what your revenue and expenses will be. This will help you figure out if your business can actually be profitable. An added benefit is that these forecasts will also help you figure out how much money you’ll need to start your business and get through the early days.

You should create the following projections:

This may sound like a lot, but it’s really not as daunting as it seems. You can make forecasting even easier if you use a tool like LivePlan, but you can also get by with spreadsheets.

When you create your forecasts, use educated guesses to guide you. Remember, no one actually knows the future, so your job is just to make good guesses at how many customers you can acquire, what they’re going to spend with you, and how much it’s going to cost you to run your business.

In previous posts, we’ve gone into more detail on forecasting sales and creating your budget. Start with these articles to learn what it takes to create the forecasts you need:

- The Recommended Sales Forecasting Method

- A Fast and Easy Way to Build an Expense Budget

- How to Read and Understand Your Profit and Loss

- Understanding Your Cash Flow Statement

- What Is a Balance Sheet, and How Do You Read It?

- The Key Elements of the Financial Plan

And, check out our free downloadable resources:

Remember, forecasting is just educated guessing, so you’ll probably go through the process a few times before you get it right. Even then, you’ll probably need to return to your forecast on monthly or quarterly basis to adjust it as your business grows. That’s what we do here at Palo Alto Software even though we’ve been in business for more than 20 years!