How to Use LivePlan to Manage Cash From a Paycheck Protection Loan

Posted By

January 11, 2021, Paycheck Protection Loan Update

Not only does this provide another opportunity to get help maintaining payroll and debt obligations and therefore extend your cash runway, but some or all of the loan may be forgiven if used to cover eligible expenses.

If you’re planning on applying, the best thing you can do for your business now is to find answers to the following questions:

- How much are you eligible to borrow?

- How much of your loan will be forgiven?

- Will you have enough cash for the next 3-6 months even with the loan?

- How does all of this affect your business long-term?

Having these answers will not only help you apply for the loan but will give you greater insight into how to best manage the funds, and your business as a whole, according to your plan.

How to plan for the use of your Paycheck Protection Loan with LivePlan

To help you answer these questions we’ll show you how to estimate your potential loan amount and develop a forecast, budget, and spending plan around the loan in LivePlan.

To get the most out of your planning, you’ll want to regularly revisit and update your forecasts and budgets on a month-to-month basis. Using a tool like LivePlan simplifies this process and allows for easy edits and updates, along with the ability to forecast multiple scenarios. To get you started, here are the necessary steps to plan for the use of your Paycheck Protection Loan.

Step 1: Estimate the amount of your Paycheck Protection Loan

The first step in the planning process is to estimate the maximum amount you qualify to borrow under the Paycheck Protection Program. The loan is intended to cover your payroll costs and a portion of your operating expenses, and only 40% of it may be used for qualifying expenses other than payroll. Here are the necessary steps to estimate what you qualify for:

1. Gather your total monthly payroll costs from the prior year. Viable payroll expenses include:

- Salaries, wages, and commission

- Cash tips

- Vacation, family, medical or sick leave payments

- Group health benefit insurance premiums

- Retirement benefits

- Allowance for dismissal or separation

- State and local taxes based on employee compensation

- Employee costs – ie. cost of remote tools, equipment, transportation, etc.

2. Now find your average total monthly payroll costs. Add up the past 12 months of payroll costs (from the list above) and divide by 12.

3. The loan amount is meant to cover two and a half months of payroll expenses and other liabilities. So, multiply your average total monthly payroll costs by 2.5 to find your estimated qualifying amount.

Note: Not all payroll costs are valid under the Paycheck Protection Program, including the following:

- Individual employee compensation in excess of $100,000 for an annual salary.

- Payroll taxes, railroad retirement taxes, and income taxes.

- Any compensation given to an employee whose primary place of residence is located outside of the United States.

- Qualified sick leave wages under section 7001 or qualified family leave wages under section 7003 of the Families First Coronavirus Response Act for which a credit is allowed.

Step 2: Create a new forecast scenario in LivePlan

Now that you have your estimated loan amount, it’s time to build a new forecast. Here’s how you can easily develop a new forecast in LivePlan:

*Note: If you have a LivePlan forecast that already includes the previous years’ accounting data and starts at the beginning of your current fiscal year, skip to step 3 to jump right into adding in your PPP loan.

1. Start a new forecast for the beginning of your current year so you have a fresh start for this scenario.

2. Your Forecast start date should be the beginning date of your fiscal year. You can either change the start date of your Forecast in the Options page of your Company, or you can archive this one, and create a new Company.

3. If your company is connected to an accounting solution: Use the drop-down above the Forecast tab and Create a New Forecast based on your accounting data. This will populate your new forecast with last year’s actual accounting figures and also populate Beginning Balances. Name it PPP, or something similar, to easily reference for later.

4. If your LivePlan account is NOT connected to an accounting solution: If you don’t have LivePlan connected to accounting software, you can instead create a Forecast manually. Use the drop-down above the Forecast tab and choose Create a New Forecast to start from scratch. Name it PPP, or something similar, to easily reference for later.

- If you start from scratch you’ll need to fill in your beginning balances which can be found in Forecast → Balance Sheet → Beginning Balances.

5. Finish your starting forecast by updating the Financial Tables for each forecast month prior to now with what actually occurred. This will keep your profit and cash balances as close to accurate as possible.

5. Finish your starting forecast by updating the Financial Tables for each forecast month prior to now with what actually occurred. This will keep your profit and cash balances as close to accurate as possible.

6. Confirm that your Beginning Balances are accurate, in Forecast → Balance Sheet → Beginning Balances. If your forecast is based on accounting data, these balances are automatically populated for you. If you created your forecast manually, you’ll need to enter them.

Step 3: Add your Paycheck Protection Loan to the forecast

Now that you’ve confirmed that everything is updated and accurate, it’s time to enter your qualifying PPP loan amount:

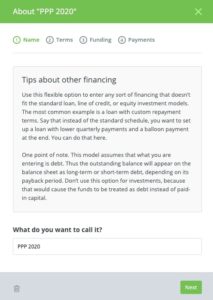

1. Under the Financing section of the Forecast tab, select “Other Loan.”

2. Name the loan PPP2020 (or something similar to easily reference).

3. Enter an interest rate of 0% for now. Once you’ve built your budget and cash forecast you’ll know more about how much you expect to be forgiven. For now, plan for your entire loan amount to be forgiven.

4. Select “Yes” when prompted “If you expect to pay back within 12 months.” This can also be edited after you create your plan.

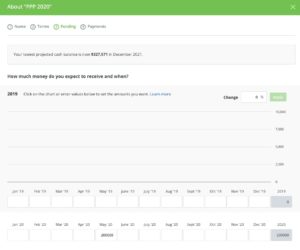

5. Under date choices, enter the full value of your eligible loan in the month you expect to receive it.

6. Make the payment 0 and leave the payments at 0 until you know how much will be forgiven. Your forecast has automatically updated to include the loan as added cash and liability. Your loan is a liability until it’s forgiven.

7. Once you apply for loan forgiveness and know how much will be forgiven, you can remove the 0% interest loan and add an Investment entry to LivePlan. Be sure to use the date you received the loan as your investment date to keep the cash in the right month and treat it as Paid In Capital.

8. If you expect any amount of the loan will be used on expenses ineligible for forgiveness, you’ll carry the loan as a liability and pay it off. Enter this as an “Other” loan at 1% interest. Interest accrues from origination, but payments are deferred for 6 months, so use the monthly payment editor to enter payments in the right months, based on origination.

Step 4: Complete a cash forecast and revised budget

In this section you’ll edit your forecast, accounting for the loan, until you have a positive cash flow, and develop a revised budget that capitalizes on the extended runway provided by the loan. Your revenue and expense forecast is your budget, and your cash forecast is your spending plan, which also helps you identify expenses that will qualify for loan forgiveness.

Editor’s note: The screenshots below are from a management scenario during the original round of funding. They are still applicable and the only difference you’ll see in your scenario is the forecasting dates you’re working with.

1. Starting from when you received the loan, enter forecast values in each of the Financial Tables through 2021. This is where you’ll need to use your best-educated guesses for your sales and related expenses in the coming months. You’ll need to fill out the following sections:

- Revenue (or sales): Be conservative with your revenue estimates, and only enter values you feel really confident about. This should accurately reflect how COVID-19 has affected your sales, which may mean consecutive months with little to no revenue.

- Cost of Goods: The cost here will be based on sales.

- Expenses: Keep in mind that certain liabilities and costs can be forgiven under the Paycheck Protection Program, including rent and utilities if the cost uses less than 25% of your loan value.

- Personnel: Your personnel records are a required piece when submitting for loan forgiveness. In order to get full loan forgiveness of eligible costs, you’ll need to retain the same number of paid employees that you had prior to receiving the loan. Additionally, employee pay cannot be decreased by more than 25% to receive full forgiveness. Note: At the time of this writing the PPP loan is unclear about contractor pay. In your LivePlan forecast, you can choose between On Staff (for payroll employees) and Contractor.

- Assets, Tax Rates, and Dividends: Add these as necessary.

2. Check your Cash Flow “Cash at End of Period balances.” Continue editing your revenue and expenses until you create cash flow balances that will work for your company. Each time you make a change in a Financial Table, it dynamically updates your Cash Flow balances.

3. Reduce your sales and expenses to the lowest possible amount during the period your business will be in crisis. From there, forecast conservatively in the months that you foresee business potentially ramping back up.

4. When you get your forecast to a state that is manageable for your company and projected cash balances are positive, find the expenses in your forecast that will qualify for loan forgiveness. This can include up to 8 weeks of payroll costs, rent, utilities, etc. Compare this sum to the amount you are eligible for and the difference is what you’ll be left with on the loan. You’ll want to update your forecast with the actual portion of the loan you’ll need to repay. Review the Add your Paycheck Protection Loan section of this article to do so.

As you build this scenario you’ll notice that your business may not be profitable in 2020, but that’s to be expected. Your cash balances need to be forecast above zero, to cover your expenses and inserting your PPP loan value is meant to help you achieve a positive cash balance.

If your cash balance is still negative after inserting the PPP loan you will need to go back to revenue and expenses and see whether there are any adjustments you can make to reduce your need for cash.

Step 5: Apply for the Paycheck Protection Loan and stick to your plan

Now that you have a plan for your PPP loan, you can jump right into the application and work with your bank to submit it. Keep in mind that if your loan is $150,000 or less, you can submit a simplified application. Also, if you’re acquiring a second draw loan, you may need to fill out a slightly different forgiveness form.

From here, it’s up to you to keep your forecast updated and actively compare it against your actuals to manage your business. Here are a few tips to help you get the most out of your plan and assure you stick to it:

- Update and check your forecast regularly, at least once a month. This assures that you’ll accurately track any changes in your business concerning revenue, expenses, personnel, etc.

- Actively monitor your Cash Flow Forecasts’ monthly cash balances to keep track of your burn rate and cash runway in the pursuit of becoming cash flow positive.

- Don’t be afraid to edit your Financial Tables. This is necessary to accurately manage profit and cash.

- Use your forecast as the basis for sales and costs. By regularly updating it, you’ll have a better understanding of potential increases and decreases based on historical information, predictions, and market conditions.

- Develop multiple forecasts based on different scenarios. The forecast you developed today, is the current worst-case scenario that will adapt into your most likely scenario. From here, you’ll want to develop a best-case and new worst-case scenario to better understand potential outcomes for your business.

- Sync LivePlan to your business’s accounting solution. If you use QuickBooks or Xero, you can connect it in the Dashboard, and easily track the forecast versus actual results there.

If you’ve gone through this process and are still unsure of the best way to manage your forecasts, LivePlan Strategic Advisors offer this type of ongoing work as part of their advisory services. Additionally, we have a compilation of planning and forecasting resources to help your business survive and thrive through the COVID-19 crisis.

Editors note: This article was originally published in April 2020 and updated to address the new round of PPP funding in January 2021.