I.D. Verification Technology Business Plan

Bionex Corporation

Executive Summary

Bionex, Inc. is a biometric security company providing solutions to remedy Identity Theft and Credit Fraud. Bionex, Inc. differentiates itself by using our (patent pending) Exigency Process. This approach processes and expresses the details of someone’s finger as a unique algorithm, rather than matching it against a stored image on a database. This process will eliminate the need to store images of millions of individual fingerprints on a database, reduce operating costs, and maximize system-wide efficiency. Our process will allow for seamless integration of biometric security into existing systems, and enable secure virtual transactions.

The market opportunity for our technology is tremendous and subject to a high growth trend. The biometric identification market is projected to exceed $4.04 billion within two years for several reasons. Credit and identity fraud cost banks and government over $47 billion last year alone. In addition, new legislation in the health care industry and rising security concerns attributed to terrorism will expand the need for biometric devices in the Healthcare and Transportation sectors. Bionex will offer several biometric solutions designed to compliment our Exigency Process and facilitate biometric accuracy and security in any environment.

Potential competitors include the Biometric Access Corporation (BAC), Bio Pay, Identix, Pay by Touch and Touch Credit. Recent exits from this market include Bioconx and Infineon which failed largely due to over-reliance on the image enrollment system. Bionex, Inc. enjoys several key competitive advantages over the competition, including:

- Our solutions are not application- or system-intrusive, meaning our products can seamlessly integrate into any existing platform.

- Our products protect user privacy and eliminate the need for a government or corporate-based database system.

- Our technology is a licensable design that can be integrated into OEM systems and products.

The marketing plan for Bionex is designed to attract new customers and capture new markets. Through strategic contacts, we will gain positive national exposure in Wired and Business Week Magazine, and positive national systems reviews from ZDNET, and CNET. Bionex aims to attract banking and financial licensing contracts by implementing complimentary testing, upgrades and POS systems. Bionex will initiate retail distribution contracts through valuable our contacts with CompUSA, BestBuy, and J&R Computer.

Our management team has extensive experience in technology development, sales, marketing, finance and customer service. Senior executives have industry specific expertise in fraud control, transaction processing, and POS payment systems. Our company is run by a Finance Major well-experienced in the biometric and financial services sectors. He is a proven entrepreneur and is joined by a team of seasoned veterans from virtually every discipline in the technology and financial services sectors.

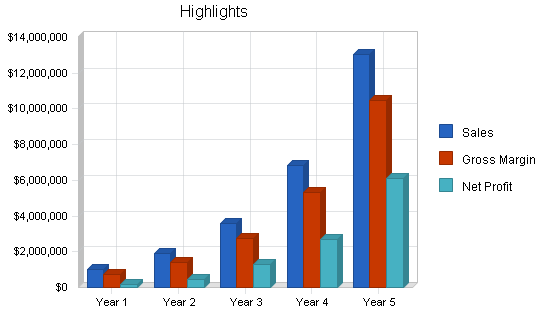

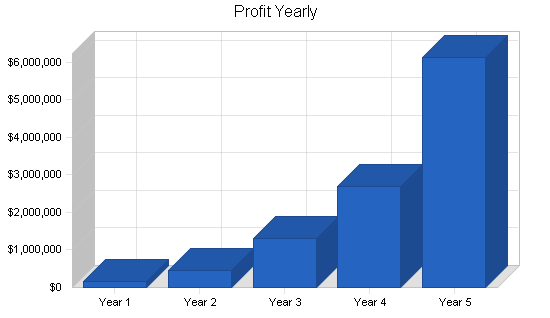

The company projects huge sales in year three with a large net profit. Bionex expects to quadruple sales to hugex4 in revenue by year five. This company is potentially profitable in year one assuming no problems with credit card licensing agreements and retail distribution contracts.

A capital investment in the next six month period would enable Bionex Inc. to make, ahead of plan, operational improvements to scale for expected growth.

Need real financials? We recommend using LivePlan as the easiest way to create financials for your own business plan. Create your own business plan

1.1 Mission

At Bionex, Inc. our main priority is to provide customers and business partners with unparalleled security and reliability. Our security solutions address three primary areas of data security:

- Protection– Bionex’s security systems authorize only users who can be positively identified via their fingerprint alone. Our Exigency Process ensures that there is no data available for potential loss or theft.

- Privacy– Our Exigency Process converts fingerprints into complex mathematical algorithms which exist only for fractions of a second.

- Flexibility– Our solutions are developed to operate over any mix of network and system infrastructures, enabling seamless integration into existing systems.

1.2 Keys to Success

- All patent applications complete and approved.

- Obtain initial private investment capital to fully fund start up development and prototype manufacture.

- Receive implementation contract for a financial institution or government branch.

- Steady Research and Development funding, to maintain a broad and diverse product line.

- Emphasis on marketing campaigns, in order to reach untapped markets, and new customers.

1.3 Objectives

- Receive capital injection during the first year.

- Generate huge sales by third year of operation.

- To make BioXert verification systems widely used transactional tokens by year five.

- To make the BioVert device the number one selling biometric device by year five.

- To expand internationally, licensing and distributing products and solutions worldwide by year six.

Company Summary

Bionex, Inc. is in the business of developing and marketing proprietary biometric technology used for transaction- and identity-verification in an array of environments. The company has pioneered the design of Exigency, an identification process that eradicates the need for image databases and other non-automated methods of identification such as personal identification numbers, passwords, tokens and smart chips, all of which are subject to loss or theft.

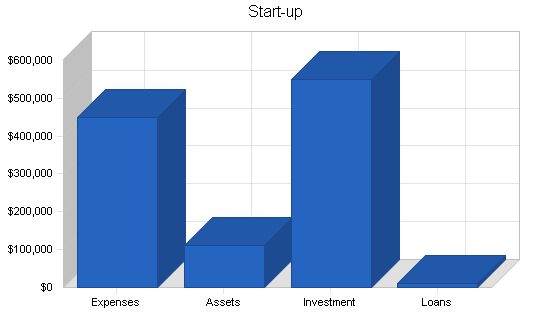

2.1 Start-up Summary

The key elements in the Start-up plan for Bionex Corporation are:

- Legal expenses for filing all patent applications.

- Six month payroll for 5 employees, including benefits and payroll taxes.

- One year rental expenses for office space in Manhattan.

- The establishment of a Corporate Identity.

- The creation of a product catalog, color brochure, and interactive web site.

We need estimated start-up expenses as shown below. We plan to raise sufficient funding to cover start-up and initial operation costs. Our founder has invested in the company and we are seeking additionalo private investment. The funds will be used to complete our patent process and initiate prototype development. The start-up capital required will also cover expenses associated with the continuation of operations in the first year. We will raise the capital by selling shares in the company. Our business plan calls for this infusion of cash in Year 1.

Need real milestones? Establish a clear path for your business with real-world examples. Create your own business plan

| Start-up Funding | |

| Start-up Expenses to Fund | $450,000 |

| Start-up Assets to Fund | $111,877 |

| Total Funding Required | $561,877 |

| Assets | |

| Non-cash Assets from Start-up | $0 |

| Cash Requirements from Start-up | $111,877 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $111,877 |

| Total Assets | $111,877 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $11,877 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $11,877 |

| Capital | |

| Planned Investment | |

| Personal Investment | $50,000 |

| Private Investor | $500,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $550,000 |

| Loss at Start-up (Start-up Expenses) | ($450,000) |

| Total Capital | $100,000 |

| Total Capital and Liabilities | $111,877 |

| Total Funding | $561,877 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Salaries | $280,000 |

| Rent | $50,000 |

| Legal Fees | $50,000 |

| Consultants | $30,000 |

| Computers | $10,000 |

| Travel | $10,000 |

| Office Supplies and Furniture | $9,500 |

| Insurance | $6,000 |

| Stationary, Brochure, and Catalog | $3,000 |

| Utilities | $1,500 |

| Total Start-up Expenses | $450,000 |

| Start-up Assets | |

| Cash Required | $111,877 |

| Other Current Assets | $0 |

| Long-term Assets | $0 |

| Total Assets | $111,877 |

| Total Requirements | $561,877 |

2.2 Company Ownership

Bionex Corporation is a privately held New York “C” Corporation. Its principal founder controls 51% the business. The balance of the shares will be sold to raise start-up capital and future investment.

Products and Services

Bionex Corporation will initially market, license and retail three distinct products supporting our Exigency technology.

- Xenasys– Licensed technology primarily for use in credit card and financial transactions. Unique algorithmic data, specific to each cardholder based on points collected from a fingerprint, are captured, extracted, and referenced at point of sale with existing algorithms preserved on card, and ultimately confirming or declining identification of cardholder within seconds.

- Xenavex– Biometrically enhanced identification systems, protected by combining Exigency technology with potent Smart Cards which are implanted into the grain of the paper upon issuance; when scanned by a biometric station, the platform will transmit confirmation of identity, status, and pertinent records against the biometric and algorithmic data of individual.

- BioXen Devices– Small, portable biometric devices in the form of adapters and keyboards to facilitate biometric transactions and verification on computers, phones, and electronic devices. These devices will be available for retail consumption for users seeking cost effective data security. These devices will also be available as permanent installation, or on-board solutions, for companies and governments through lease arrangements.

Market Analysis Summary

The biometric security industry reported an estimated $601 million in revenues in 2002, and industry revenues are expected to reach $4.04 billion by 2007 (International Biometric Group, Market Report 2003).

Banks and governments are looking for methods to prevent credit and identification fraud. In a post-September 11th world, measures need to be taken to ensure security and safety and prevent fraud and ID theft. In 2002 alone, credit card and identity theft costs banks and government over $47 billion dollars in losses (FTC Overview Report, 2003).

Identity theft, stolen credit cards, phony checks, benefits fraud, network hacking, and other impostor scams to defraud businesses, government agencies and consumers costs billions of dollars per year. It is a problem that drives up prices of goods, increases taxes, complicates routine transactions, and strains law enforcement resources. Until recently, the only way to way to attack the problem has been to add expensive screening and administration procedures; steps such as hiring security guards, maintaining accurate databases, reviewing identity documents, administering password systems and asking personal questions have proven to be costly measures, that are easily defeated by enterprising crooks.

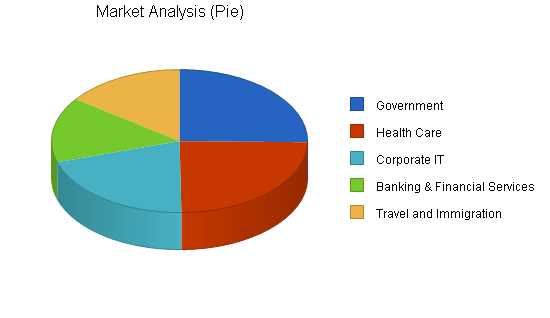

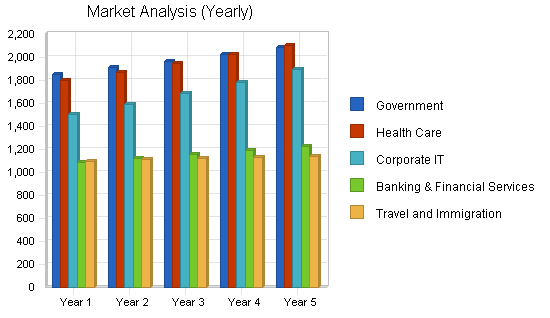

4.1 Market Segmentation

The potential domestic customers for Bionex include:

The Government Sector, which will be the leading biometric market through 2007 with over $1.2 billion in annual spending (International Biometrics Group). For law enforcement, the military, the judiciary, education, and social services, use of fingerprint authentication solutions from Bionex are suitable for deployment in many government operations, including:

- Government entitlement programs:Identifying and validating the correct person (fraud in government entitlement programs is estimated at over $10 billion a year — General Accounting Office, Biometrics Consortium.)

- Law Enforcement:Identifying criminals and controlling access in jails and prisons.

- Education:Attendance systems for distance learning and Internet based classes.

- Military:Secure and verified authentication to classified information, physical access to authorized areas, and military equipment control.

- Government services:Secure physical and electronic voting systems, voter registration, vehicle registration, citizen ID projects, and state licenses.

The Healthcare industryis expected to be one of the fastest growing supporters of biometric technology. Increased activity in this sector can be attributed to the Health Insurance Portability and Accountability Act of 1996 (HIPAA), a law that addresses the way that healthcare is managed and administered in the U.S. In addition, in 2002 there were 5,801 Hospitals across the United States (Hospital Statistics, published by the American Hospital Association) with security and IT spending budgets increasing 8% from 2001 (American Hospital Association). The ability to positively identify an individual is absolutely essential to the healthcare industry. Biometrics, when deployed properly, will provide solutions for administering prescriptions and service, accessing and storing medical histories securely, and verifying access to proprietary information.

For the Corporate IT marketamong the country’s top 1500 companies, IT security is a critical issue, since most information now resides in electronic form. The most widely used methods of controlling access to computers and data in the Corporate IT environment are passwords and PIN numbers, which are rarely changed, often forgotten, frequently shared, often used in plain sight and easily defeated using common hacker programs. Gartner Groups states that password maintenance costs $400 to $600 per user per year, and that 20 to 50 percent of all calls to company help desks are from people needing their passwords reset. As a result, passwords provide poor protection from data theft, and poor network security, at a high cost. Replacing passwords and PIN numbers with fingerprint authentication devices from Bionex will make access to corporate information more efficient and more secure.

The Banking and Financial industrieswill follow with an anticipated $672 million in spending through 2007 (International Biometrics Group). According to the 1997 US Census there were 588 credit card issuing banks and 11,036 federally chartered savings banks in the country. In 2002, there was over $14 billion in credit card and account fraud (Federal Trade Commission ID Theft Survey Report 2003). Due to the strong demand for secure networks and transactions, Bionex has developed secure biometric platforms for Financial Services institutions, enabling a range of biometric technologies for background checks, credit and debit transactional verification, physical access or internal network security systems, and ATM and teller authentication solutions, all while addressing major biometric concerns such as interoperability, integration, accuracy, and enrollment.

The Travel and Transportation industrywill reportedly spend $556 million on biometrics through the year 2007 (International Biometrics Group). Additionally, biometrics are explicitly cited in two pieces of recent U.S. legislation, including the Aviation and Transportation Security Act (signed in November 2001), and the Enhanced Border Security and Visa Reform Act (signed in May 2002), each of which calls for the implementation of biometric technology to enhance homeland security. In 2002, there were 635 certified public airports in the United States (National Bureau of Transportation Statistics 2002). These airports are targets for terrorism, and are also potential sites for such criminal activities as theft, smuggling, and evasion of law enforcement authorities. Using biometrics to ensure personal authentication and provide increased homeland security will reduce labor costs and increase aviation security to meet today’s demands. With fingerprint authentication solutions from Bionex, many operations can be implemented securely, such as:

- Checking airline employee backgrounds.

- Controlling and managing physical access rights to all authorized areas of the airport.

- Control and managing user access to airport computer network/database.

- Securely matching passengers to their IDs, passports, visas, boarding pass, and baggage.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Government | 3% | 1,854 | 1,910 | 1,967 | 2,026 | 2,087 | 3.00% |

| Health Care | 4% | 1,801 | 1,873 | 1,948 | 2,026 | 2,107 | 4.00% |

| Corporate IT | 6% | 1,500 | 1,590 | 1,685 | 1,786 | 1,893 | 5.99% |

| Banking & Financial Services | 3% | 1,088 | 1,121 | 1,155 | 1,190 | 1,226 | 3.03% |

| Travel and Immigration | 1% | 1,099 | 1,110 | 1,121 | 1,132 | 1,143 | 0.99% |

| Total | 3.59% | 7,342 | 7,604 | 7,876 | 8,160 | 8,456 | 3.59% |

4.2 Target Market Segment Strategy

Bionex will focus development on the fingerprint technology segment of the Biometrics Industry. We will specialize in the following fingerprint-based biometric solutions for the following target markets:

- Driver Licenses

- Passports

- Government Entitlement Programs

- Immigration and Border Control

- Credit Cards

- Debit Cards

- Automatic Teller Machines (ATMs)

- POS Systems

- Access to computers

- Access to networks

- Access to buildings and rooms

4.3 Service Business Analysis

Bionex operates in the Finger-Scan segment of the biometric technology industry. The industry is comprised of 8 segments:

Finger-Scan, Facial-Scan, Iris-Scan, Voice-Scan, Signature-Scan, Keystroke-Scan, Hand-Scan, and Middleware.

The table below outlines market share commanded by each segment. Fingerprint-based technologies are projected to account for 52.0% of 2003 industry market share, far and away the largest technology segment in the industry.

2003 Comparative Market Share by Technology

| Finger-Scan | 52.0% |

| Middleware | 12.4% |

| Facial-Scan | 11.4% |

| Hand-Scan | 10.0% |

| Iris-Scan | 7.3% |

| Voice-Scan | 4.1% |

| Signature-Scan | 2.4% |

| Keystroke-Scan | 0.3% |

Source: Copyright 2003 International Biometric Group

The following table displays total biometric revenues projected from 2002- 2007. A steady, fast-paced growth is anticipated for the biometrics industry.

Total Biometric Revenues 2002-2007 (millions)

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 |

| $601 | $928 | $1,467 | $2,199 | $3,112 | $4,035 |

Source: Copyright 2002 International Biometric Group

4.3.1 Competition and Buying Patterns

There are 18 leading biometric fingerprint companies with established brand names and distribution patterns in the USA; these companies have a distinct advantage in the biometrics security arena. But new, small companies are succeeding on a regular basis with cost-saving innovations, newer technology, and implementation advantages. Lower product costs, lower failure rates, and lower education curves than the established competitors are essential to successful entrance into the market. In order to effectively enter the biometrics market, products must also deliver faster performance, more complex security algorithms, and better privacy solutions.

Bionex will succeed based upon the capability of its products. Our solutions are competitively priced, easier to implement, provide faster performance, and more complex security platforms. Bionex expects high future market share in our market segment (biometric financial and ID verification).

Biometric Verification is a huge and growing market, including both transaction and identification-oriented needs. The market for biometric transactions currently contains three unique solutions from Biopay, Pay-By-Touch, and TouchCredit. This clearly defined market represents one of the fastest growing segments in the financial industry. The market for biometric identification contains two unique solutions from Biometrics Access Corporation, and Identix, respectively.

Bionex differentiates itself from the competition by providing solutions that are scalable to both the retail and internet level. Both physical and non-physical biometric security can be retained and ensured by the Exigency technology. Until now, biometric providers have focused on only one side of the market, leaving the other side exposed to the same problems they are trying to solve. Bionex solutions, unlike existing biometric payment systems, does not store any data, images, or account information on any database or server. This offers users the highest level of privacy, and anonymity.

Need real financials? We recommend using LivePlan as the easiest way to create financials for your own business plan. Create your own business plan

4.3.2 Main Competitors

There are 341 Biometric companies in the world. In the USA, there are 151 biometric companies; of those, only 93 focus on fingerprint biometrics (Biometric Information Directory). Our company is seeking to penetrate the Biometrics Financial and Identification markets. Our main competitors in the market include:

- Biometric Access Corporation (BAC)is a systems integration and software/hardware development company that provides identity verification solutions for retail financial transactions, time and attendance and PC/network security. As the sole proprietor of our SecureTouch finger image authentication products, BAC designs, develops, manufactures and markets several hardware and software applications to provide complete user solutions.

- BioPaywas created in 1999 to offer businesses unprecedented tools to eliminate fraud, increase revenue and improve customer convenience. BioPay’s integrated biometric technology takes advantage of the advances and reduced prices of hardware and software not available until recently. Consumers can now use their fingers to conveniently cash checks, make purchases, and, most importantly, protect their identity.

- Identixis the world’s leading multi-biometrics security technology company. As the industry leader in both fingerprint identification and facial recognition technology, Identix is positioned to respond to the growing demand for biometric products and solutions across multiple security markets. By offering solutions that enhance privacy, provide credentialed authorization, increase security and convenience and reduce the likelihood of a possible breach or fraud, Identix truly does empower identification

- Pay By Touchis the premier provider of tokenless authentication at the point of sale, offering retailers and shoppers a secure and efficient checkout experience. Pay By Touch is a service that allows your customers to pay for purchases by using a simple, secure method of finger imaging at the point of sale, completely eliminating the need to carry cards, checks, or cash.

- TouchCredit™ Financial Services, Inc.is a leading provider of web-based identity authentication and biometric verification solutions. TouchCredit’s products can help significantly reduce online payment fraud and ensure transaction and account access integrity throughout the complete electronic processing life cycle.

Our top five competitors all focus on secure biometric transactions and authentication, but none of them yet provide a cost-effective biometric credit card, or ID platform for widespread integration into any of the potential markets. Nor can any of these existing companies can provide customers with any sort of solution for both biometric internet and retail transactions. Failures on their part such as poor accuracy, long transaction times, privacy issues, system integration and enrollment issues still have not been solved. Even if the competition improves their existing technology and solves some issues, they will still have to deal with privacy concerns, integration problems and the significant costs associated with maintaining and protecting the databases, not to mention that their systems still will not provide a dual internet and physical transaction platform.

Bionex sees competition failure as a major opportunity to exploit the market, using our patent pending Exigency technology for use in Xenosys, Xenevex, and BioXen products. Successful penetration will render their technology obsolete and establish Bionex as a leader in the Biometric industry.

Strategy and Implementation Summary

Bionex, Inc. will pursue specific, definable, market segments with a multi-tiered, multi-channel approach. We will leverage our technologies with a licensing agreement in one key area and a direct sales and distribution strategy in the other using established distributors. We will look to foreign markets in the future through established distributors for additional revenue.

5.1 Competitive Edge

Our competitive edge lies with our technology and our philosophy. Our technology is designed to eliminate financial and identity fraud while preserving privacy. We believe customers’ privacy is sacred, and their account information should remain protected at all times, during transactions or when they are asleep. We have developed biometric solutions that more cost effective and will make broad integration cheaper and easier than ever. In addition, we aim to provide our retail customers with one of the best technical support and warranty plans in the industry. Our support will offer a toll-free number, twenty-four-hour live operator support, and a limited lifetime warranty. Our company will strive to provide custom applications and software tailored specifically to our customers’ needs.

To develop good business strategies, perform a SWOT analysis of your business. It's easy with our free guide and template.Learn how to perform a SWOT analysis

5.2 Marketing Strategy

Public relations and industry media will help in overall industry awareness plans. Feature articles and product reviews will help launch awareness of our products. Direct mail to buying groups and ads in trade publications will help with buyer impressions. The top 20 to 30 customers in each segment will be approached first; a few sales hits in these top tiers will enable achievement of targeted forecasts. Bionex will achieve its initial sales goals from direct and distributed sales of BioXen biometric devices. Our products will saturate the market and fill the void for personal biometric devices. Worldwide sales through distributors will provide needed cash flow; sales of Xenosys and Xenavex will begin shortly thereafter. We believe our complimentary Point of Sale strategy and increased help from select consultants will trigger enhanced growth in the financial and government arenas.

5.3 Sales Strategy

Bionex expects to generate revenue from domestic licensing and sales of Xenasys transaction systems, Xenavex identity platforms and BioXen biometric devices. In order to sustain strong sales and royalties for expansion and growth, Bionex will prioritize research and development. Through R & D we can continue to bring cost-effective biometric technologies to market. To initiate sales, Bionex plans to hire consultants with ongoing business relationships with government entities, and credit card companies; we will rely on them to introduce key leads and initiate contracts right from the start. In addition, key contacts with senior writers for Wired Magazine, Business Week, CNet, and ZDnet will bring positive national attention to our technology and products.

Bionex anticipates that initial revenues will come from licensing agreements of Xenasys to credit-issuing banks supporting Visa, Mastercard, Discover and American Express who are seeking to attract or retain customers on the basis of fraud prevention, verified transactions and secure account management systems. Bionex seeks to facilitate widespread use of Biometric Credit Cards by implementing complimentary Biometric point of sale systems for leading retailers and merchants seeking to avoid fraud losses, and improve customer satisfaction by enabling more secure transactions for potential customers in their retail networks. Bionex plans to collect additional revenue in the future from licensing our biometric transactional platform to internet payment gateways (VeriSign, Authorize Net, Paypal, Western Union, CyberCash etc.) and credit card companies (Visa, Mastercard, American Express, Discover).

Bionex will rigorously pursue government contracts from federal, state and local governments. Our strategy in obtaining these contracts will be to provide distinct, all-in-one solutions (software, hardware, installation and support), saving the government money and time, and increasing productivity and security while solving implementation issues. We will enlist the help of consultants familiar with government bidding processes, and who have contacts within different departments.

Bionex will also distribute a diversified line of BioXen personal biometric products through electronic retailers such as CompUSA, BestBuy, Circuit City, J&R, RadioShack, etc. Because Bionex is a new entity, we understand that we will have to prove our company’s worth to distributors in order to earn their respect and business. We will promptly honor all dealer requests for product samples. We will offer an 800 number phone line and have full-time customer service to meet distributors’ needs. Our product line will fulfill the demand of thousands of customers with a discerning priority, need and interest for the latest in personal security. Bionex will continue to expand our BioXert product line with introduction of biometric mice, biometric keyboards, biometric ethernet cards, biometric pda devices, biometric removable hard drives, etc.

Bionex will market our Biometric Physical/Network access solutions to the healthcare industry, and exploit recent legislation requiring stronger security measures, by providing compliant biometric solutions which are cost-effective, easy to use, and easily integrated.

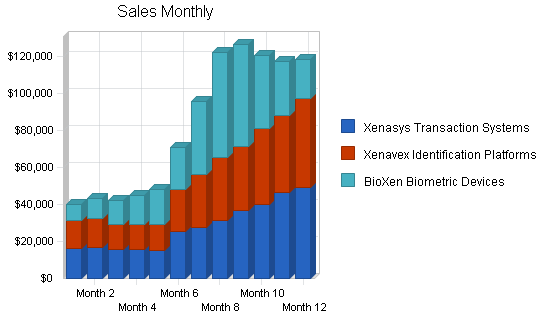

5.3.1 Sales Forecast

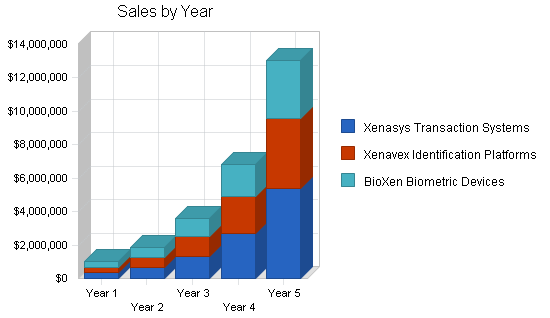

The following table and related charts show our present sales forecast. We are projecting healthy sales in 2006. We are forecasting sales to increase to ‘huge’ in year two with expanded marketing expenditures and reach. Sales are expected to grow steadily through 2010 and beyond. We project continued success and increasing sales due to recognized brand name, proven track record, international expansion, and strategic acquisitions. Future expansion will also contribute to an increase in sales revenue from development of new products, new markets, and new demands.

Need real financials? We recommend using LivePlan as the easiest way to create financials for your own business plan. Create your own business plan

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

| Sales Forecast | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | |||||

| Xenasys Transaction Systems | $335,019 | $670,038 | $1,340,076 | $2,680,152 | $5,360,304 |

| Xenavex Identification Platforms | $322,335 | $612,437 | $1,163,629 | $2,210,896 | $4,200,702 |

| BioXen Biometric Devices | $330,413 | $594,744 | $1,070,539 | $1,926,971 | $3,468,548 |

| Total Sales | $987,767 | $1,877,219 | $3,574,245 | $6,818,019 | $13,029,554 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Xenasys Transaction Systems | $90,909 | $159,091 | $278,409 | $487,215 | $852,627 |

| Xenavex Identification Platforms | $89,944 | $157,402 | $275,454 | $482,044 | $843,576 |

| BioXen Biometric Devices | $94,727 | $165,772 | $290,101 | $507,678 | $888,436 |

| Subtotal Direct Cost of Sales | $275,580 | $482,265 | $843,964 | $1,476,937 | $2,584,639 |

5.4 Milestones

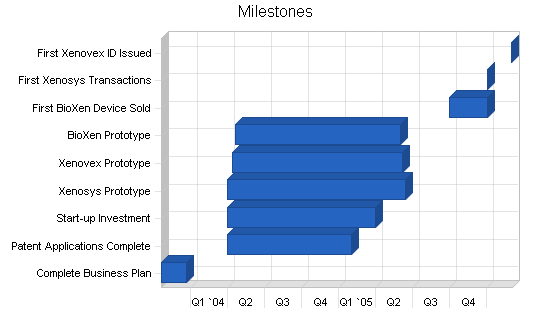

The following are the key milestones for the first years of operation:

- All patents applied for by April 1st, 2005.

- Start-up capital successfully raised.

- Working prototypes of Xenosys, Xenovex and BioXen ready by June 2005.

- BioXen products to appear in retail stores for 2005 Holiday Season.

- Obtain contract(s) from financial industry and government sectors before January, 2006.

Need impressive charts? Discover the simplest way to create detailed graphs for your business plan. Create your own business plan

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Complete Business Plan | 10/22/2003 | 12/22/2003 | $0 | Kerben | Executive |

| Patent Applications Complete | 4/1/2004 | 2/1/2005 | $50,000 | Eisenberg | R&D |

| Start-up Investment | 4/1/2004 | 4/1/2005 | $0 | Rosen | Finance |

| Xenosys Prototype | 4/1/2004 | 6/14/2005 | $50,000 | Eisenberg | R&D |

| Xenovex Prototype | 4/14/2004 | 6/7/2005 | $50,000 | Eisenberg | R&D |

| BioXen Prototype | 4/21/2004 | 6/1/2005 | $30,000 | Eisenberg | R&D |

| First BioXen Device Sold | 10/1/2005 | 1/1/2006 | $0 | Bernstein | Marketing |

| First Xenosys Transactions | 1/1/2006 | 1/2/2006 | $0 | Bernstein | Marketing |

| First Xenovex ID Issued | 3/1/2006 | 3/2/2006 | $0 | Bernstein | Marketing |

| Totals | $180,000 |

Management Summary

Bionex, Inc. has assembled a world-class management team to implement its product and business strategies. The Bionex engineering team has demonstrated experience in conducting state-of-the-art research to determine technology trends and then develop products to meet that demand, significantly ahead of the competition. The marketing manager has substantial experience in successfully introducing new technology in a robust market. The sales manager is disciplined, proven and well trained through years of experience in a corporate sale structure.

6.1 Personnel Plan

The Personnel Plan below shows the salaries for the five principle managers over the next five years. The “Total People” row chronicles the projected growth of the organization to 15 employees in the first three years; these non-managerial employees will be independently contracted, so expenses related to their payroll amounts are listed in the Profit and Loss Table. The third year could require a few additional people, especially if sales reach or exceed $2.5 million. Payroll costs will be high from the beginning, due to the need for highly trained, highly skilled labor. In order to continue growth into the future and provide accurate, secure devices we will need to recruit highly skilled labor in the fields of programming, engineering and designing; these are positions essential to company growth and are jobs that should be well compensated.

| Personnel Plan | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| CEO | $82,000 | $88,000 | $90,000 | $100,000 | $105,000 |

| CFO | $82,000 | $88,000 | $90,000 | $100,000 | $105,000 |

| President of Engineering | $72,000 | $74,000 | $75,000 | $80,000 | $85,000 |

| President of Sales | $72,000 | $74,000 | $75,000 | $80,000 | $85,000 |

| President of Marketing | $72,000 | $74,000 | $75,000 | $80,000 | $85,000 |

| Total People | 5 | 10 | 15 | 25 | 45 |

| Total Payroll | $380,000 | $398,000 | $405,000 | $440,000 | $465,000 |

Financial Plan

The value of the patents and the size of their potential markets enables several back-up plans of action if this plan doesn’t work as indicated. Venture capital can be pursued, and historically, investments of $250,000 to $750,000 thousand are common for similar companies. Even after successfully completing the start-up and seed stages as indicated, second round venture or mezzanine funding is potentially available in the $1 million range to motivate future growth.

7.1 Important Assumptions

Our plan is based on the following key assumptions for our U.S.-based, New York corporation:

- Sufficient access to capital.

- Steady economy without a major recession.

- No unforeseen changes to ISO biometric standards.

| General Assumptions | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Plan Month | 1 | 2 | 3 | 4 | 5 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% |

| Tax Rate | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% |

| Other | 0 | 0 | 0 | 0 | 0 |

7.2 Break-even Analysis

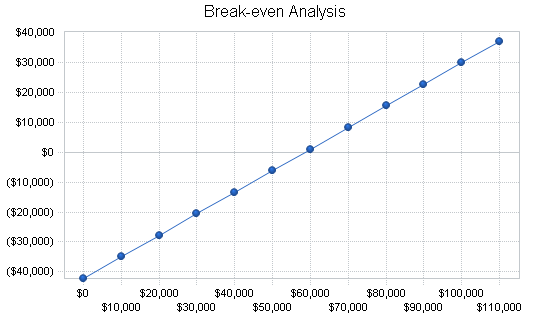

For our break-even analysis, we calculated per month running costs, which include our payroll, rent, utilities, insurance and an estimation of other running costs. The chart shows what we need to sell per month to break-even, according to these assumptions.

Need real milestones? We recommend using LivePlan as the easiest way to create milestones for your own business plan. Create your own business plan

| Break-even Analysis | |

| Monthly Revenue Break-even | $58,540 |

| Assumptions: | |

| Average Percent Variable Cost | 28% |

| Estimated Monthly Fixed Cost | $42,208 |

7.3 Projected Profit and Loss

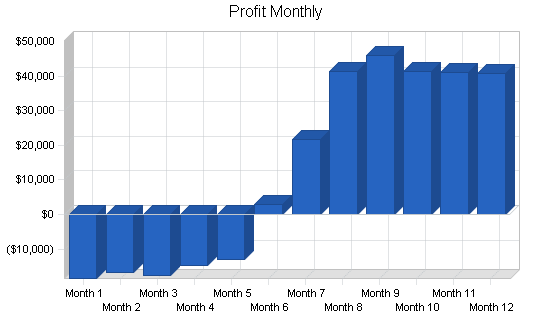

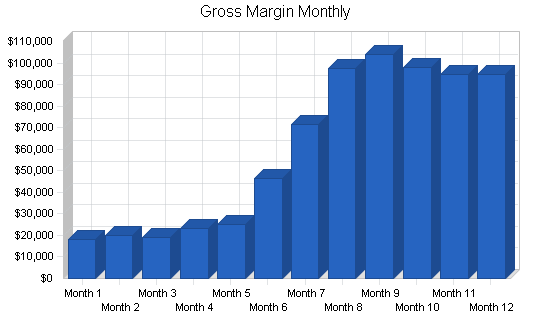

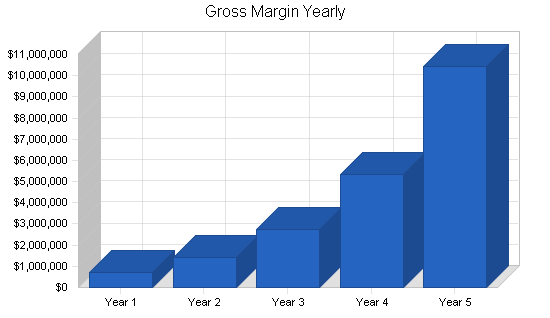

The following table and chart displays profit and loss expectations for Bionex. The company will begin to make a profit in September of its first year of operation.

Need real milestones? We recommend using LivePlan as the easiest way to create milestones for your own business plan. Create your own business plan

Need real financials? We recommend using LivePlan as the easiest way to create financials for your own business plan. Create your own business plan

Need impressive charts? Discover the simplest way to create detailed graphs for your business plan. Create your own business plan

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

| Pro Forma Profit and Loss | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | $987,767 | $1,877,219 | $3,574,245 | $6,818,019 | $13,029,554 |

| Direct Cost of Sales | $275,580 | $482,265 | $843,964 | $1,476,937 | $2,584,639 |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $275,580 | $482,265 | $843,964 | $1,476,937 | $2,584,639 |

| Gross Margin | $712,187 | $1,394,954 | $2,730,281 | $5,341,082 | $10,444,915 |

| Gross Margin % | 72.10% | 74.31% | 76.39% | 78.34% | 80.16% |

| Expenses | |||||

| Payroll | $380,000 | $398,000 | $405,000 | $440,000 | $465,000 |

| Sales and Marketing and Other Expenses | $12,000 | $20,000 | $40,000 | $300,000 | $140,000 |

| Depreciation | $0 | $0 | $0 | $0 | $0 |

| Contracted Employees | $0 | $125,000 | $300,000 | $700,000 | $1,360,000 |

| Rent | $49,992 | $100,000 | $100,000 | $150,000 | $150,000 |

| Utilities | $1,500 | $5,000 | $5,000 | $10,000 | $10,000 |

| Insurance | $6,000 | $20,000 | $25,000 | $40,000 | $40,000 |

| Payroll Taxes | $57,000 | $59,700 | $60,750 | $66,000 | $69,750 |

| Other | $0 | $50,000 | $50,000 | $50,000 | $50,000 |

| Total Operating Expenses | $506,492 | $777,700 | $985,750 | $1,756,000 | $2,284,750 |

| Profit Before Interest and Taxes | $205,695 | $617,254 | $1,744,531 | $3,585,082 | $8,160,165 |

| EBITDA | $205,695 | $617,254 | $1,744,531 | $3,585,082 | $8,160,165 |

| Interest Expense | $0 | $0 | $0 | $0 | $0 |

| Taxes Incurred | $51,424 | $154,313 | $436,133 | $896,271 | $2,040,041 |

| Net Profit | $154,272 | $462,940 | $1,308,398 | $2,688,812 | $6,120,124 |

| Net Profit/Sales | 15.62% | 24.66% | 36.61% | 39.44% | 46.97% |

7.4 Projected Cash Flow

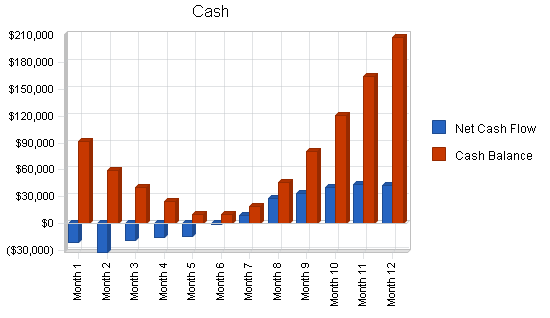

We plan to begin the year with start-up capital from initial investment of the founder, family and a private investor. Thus, although our initial cash flow is negative, our cash balance will remain positive throughout year one, as we establish ourselves in the market.

Need real milestones? We recommend using LivePlan as the easiest way to create milestones for your own business plan. Create your own business plan

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $592,660 | $1,126,331 | $2,144,547 |

| Cash from Receivables | $302,584 | $667,574 | $1,270,740 |

| Subtotal Cash from Operations | $895,245 | $1,793,905 | $3,415,287 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $895,245 | $1,793,905 | $3,415,287 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $380,000 | $398,000 | $405,000 |

| Bill Payments | $419,510 | $978,612 | $1,791,430 |

| Subtotal Spent on Operations | $799,510 | $1,376,612 | $2,196,430 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $799,510 | $1,376,612 | $2,196,430 |

| Net Cash Flow | $95,735 | $417,293 | $1,218,857 |

| Cash Balance | $207,612 | $624,906 | $1,843,763 |

7.5 Projected Balance Sheet

The highlights of the balance sheets are the cash position and the net worth at the end of year three. As seen in the balance sheet, a strong growth in net worth is expected over the next five years.

| Pro Forma Balance Sheet | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Assets | |||||

| Current Assets | |||||

| Cash | $207,612 | $624,906 | $1,843,763 | $4,379,012 | $10,143,768 |

| Accounts Receivable | $92,523 | $175,836 | $334,794 | $638,632 | $1,220,456 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $300,135 | $800,742 | $2,178,556 | $5,017,644 | $11,364,225 |

| Long-term Assets | |||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $300,135 | $800,742 | $2,178,556 | $5,017,644 | $11,364,225 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Current Liabilities | |||||

| Accounts Payable | $45,863 | $83,530 | $152,946 | $303,223 | $529,679 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $45,863 | $83,530 | $152,946 | $303,223 | $529,679 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $45,863 | $83,530 | $152,946 | $303,223 | $529,679 |

| Paid-in Capital | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 |

| Retained Earnings | ($450,000) | ($295,728) | $167,212 | $1,475,610 | $4,164,422 |

| Earnings | $154,272 | $462,940 | $1,308,398 | $2,688,812 | $6,120,124 |

| Total Capital | $254,272 | $717,212 | $2,025,610 | $4,714,422 | $10,834,545 |

| Total Liabilities and Capital | $300,135 | $800,742 | $2,178,556 | $5,017,644 | $11,364,225 |

| Net Worth | $254,272 | $717,212 | $2,025,610 | $4,714,422 | $10,834,545 |

7.6 Business Ratios

The year three return on equity should be very attractive to early investors. All ratios are in good shape for traditional borrowing to fund further growth. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7382.9903 Protective devices, security, are shown for comparison.

| Ratio Analysis | ||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Industry Profile | |

| Sales Growth | 0.00% | 90.05% | 90.40% | 90.75% | 91.10% | 7.51% |

| Percent of Total Assets | ||||||

| Accounts Receivable | 30.83% | 21.96% | 15.37% | 12.73% | 10.74% | 22.90% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 42.13% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 69.02% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 30.98% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 15.28% | 10.43% | 7.02% | 6.04% | 4.66% | 32.36% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 18.49% |

| Total Liabilities | 15.28% | 10.43% | 7.02% | 6.04% | 4.66% | 50.85% |

| Net Worth | 84.72% | 89.57% | 92.98% | 93.96% | 95.34% | 49.15% |

| Percent of Sales | ||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 72.10% | 74.31% | 76.39% | 78.34% | 80.16% | 100.00% |

| Selling, General & Administrative Expenses | 55.57% | 50.05% | 40.10% | 38.96% | 33.22% | 84.14% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.79% |

| Profit Before Interest and Taxes | 20.82% | 32.88% | 48.81% | 52.58% | 62.63% | 1.59% |

| Main Ratios | ||||||

| Current | 6.54 | 9.59 | 14.24 | 16.55 | 21.45 | 1.60 |

| Quick | 6.54 | 9.59 | 14.24 | 16.55 | 21.45 | 1.23 |

| Total Debt to Total Assets | 15.28% | 10.43% | 7.02% | 6.04% | 4.66% | 3.32% |

| Pre-tax Return on Net Worth | 80.90% | 86.06% | 86.12% | 76.05% | 75.32% | 59.08% |

| Pre-tax Return on Assets | 68.53% | 77.09% | 80.08% | 71.45% | 71.81% | 8.10% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Net Profit Margin | 15.62% | 24.66% | 36.61% | 39.44% | 46.97% | n.a |

| Return on Equity | 60.67% | 64.55% | 64.59% | 57.03% | 56.49% | n.a |

| Activity Ratios | ||||||

| Accounts Receivable Turnover | 4.27 | 4.27 | 4.27 | 4.27 | 4.27 | n.a |

| Collection Days | 56 | 65 | 65 | 65 | 65 | n.a |

| Accounts Payable Turnover | 9.89 | 12.17 | 12.17 | 12.17 | 12.17 | n.a |

| Payment Days | 28 | 23 | 23 | 23 | 24 | n.a |

| Total Asset Turnover | 3.29 | 2.34 | 1.64 | 1.36 | 1.15 | n.a |

| Debt Ratios | ||||||

| Debt to Net Worth | 0.18 | 0.12 | 0.08 | 0.06 | 0.05 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||||

| Net Working Capital | $254,272 | $717,212 | $2,025,610 | $4,714,422 | $10,834,545 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||||

| Assets to Sales | 0.30 | 0.43 | 0.61 | 0.74 | 0.87 | n.a |

| Current Debt/Total Assets | 15% | 10% | 7% | 6% | 5% | n.a |

| Acid Test | 4.53 | 7.48 | 12.05 | 14.44 | 19.15 | n.a |

| Sales/Net Worth | 3.88 | 2.62 | 1.76 | 1.45 | 1.20 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Xenasys Transaction Systems | 0% | $16,000 | $16,650 | $15,548 | $15,730 | $15,239 | $25,125 | $27,444 | $31,260 | $36,649 | $39,697 | $46,501 | $49,176 |

| Xenavex Identification Platforms | 0% | $15,255 | $15,793 | $13,562 | $13,597 | $13,936 | $22,626 | $28,720 | $34,279 | $34,370 | $41,000 | $41,487 | $47,710 |

| BioXen Biometric Devices | 0% | $8,766 | $10,607 | $12,834 | $15,530 | $18,791 | $22,737 | $39,511 | $56,289 | $55,280 | $39,738 | $28,973 | $21,358 |

| Total Sales | $40,021 | $43,050 | $41,944 | $44,857 | $47,966 | $70,488 | $95,675 | $121,828 | $126,299 | $120,435 | $116,961 | $118,244 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Xenasys Transaction Systems | $7,211 | $7,524 | $7,855 | $7,206 | $7,579 | $7,973 | $7,392 | $7,835 | $7,306 | $7,804 | $7,332 | $7,892 | |

| Xenavex Identification Platforms | $7,211 | $7,472 | $7,745 | $7,032 | $7,334 | $7,651 | $7,983 | $7,332 | $7,699 | $7,084 | $7,488 | $7,913 | |

| BioXen Biometric Devices | $7,700 | $7,985 | $7,284 | $7,598 | $7,928 | $8,275 | $8,639 | $9,020 | $7,421 | $7,843 | $7,285 | $7,749 | |

| Subtotal Direct Cost of Sales | $22,122 | $22,981 | $22,884 | $21,836 | $22,841 | $23,899 | $24,014 | $24,187 | $22,426 | $22,731 | $22,105 | $23,554 |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| CEO | 0% | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $5,000 |

| CFO | 0% | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $5,000 | $7,000 |

| President of Engineering | 0% | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 |

| President of Sales | 0% | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 |

| President of Marketing | 0% | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 |

| Total People | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | |

| Total Payroll | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $30,000 | $30,000 |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | |

| Tax Rate | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $40,021 | $43,050 | $41,944 | $44,857 | $47,966 | $70,488 | $95,675 | $121,828 | $126,299 | $120,435 | $116,961 | $118,244 | |

| Direct Cost of Sales | $22,122 | $22,981 | $22,884 | $21,836 | $22,841 | $23,899 | $24,014 | $24,187 | $22,426 | $22,731 | $22,105 | $23,554 | |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $22,122 | $22,981 | $22,884 | $21,836 | $22,841 | $23,899 | $24,014 | $24,187 | $22,426 | $22,731 | $22,105 | $23,554 | |

| Gross Margin | $17,899 | $20,069 | $19,060 | $23,021 | $25,125 | $46,589 | $71,661 | $97,641 | $103,873 | $97,704 | $94,856 | $94,690 | |

| Gross Margin % | 44.72% | 46.62% | 45.44% | 51.32% | 52.38% | 66.09% | 74.90% | 80.15% | 82.24% | 81.13% | 81.10% | 80.08% | |

| Expenses | |||||||||||||

| Payroll | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $30,000 | $30,000 | |

| Sales and Marketing and Other Expenses | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Contracted Employees | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | |

| Utilities | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | |

| Insurance | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Payroll Taxes | 15% | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,500 | $4,500 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $42,591 | $42,591 | $42,591 | $42,591 | $42,591 | $42,591 | $42,591 | $42,591 | $42,591 | $42,591 | $40,291 | $40,291 | |

| Profit Before Interest and Taxes | ($24,692) | ($22,522) | ($23,531) | ($19,570) | ($17,466) | $3,998 | $29,070 | $55,050 | $61,282 | $55,113 | $54,565 | $54,399 | |

| EBITDA | ($24,692) | ($22,522) | ($23,531) | ($19,570) | ($17,466) | $3,998 | $29,070 | $55,050 | $61,282 | $55,113 | $54,565 | $54,399 | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | ($6,173) | ($5,631) | ($5,883) | ($4,893) | ($4,367) | $999 | $7,268 | $13,763 | $15,321 | $13,778 | $13,641 | $13,600 | |

| Net Profit | ($18,519) | ($16,892) | ($17,648) | ($14,678) | ($13,100) | $2,998 | $21,803 | $41,288 | $45,962 | $41,335 | $40,924 | $40,799 | |

| Net Profit/Sales | -46.27% | -39.24% | -42.07% | -32.72% | -27.31% | 4.25% | 22.79% | 33.89% | 36.39% | 34.32% | 34.99% | 34.50% |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $24,013 | $25,830 | $25,167 | $26,914 | $28,780 | $42,293 | $57,405 | $73,097 | $75,779 | $72,261 | $70,177 | $70,946 | |

| Cash from Receivables | $0 | $534 | $16,049 | $17,205 | $16,817 | $17,984 | $19,487 | $28,531 | $38,619 | $48,791 | $50,441 | $48,128 | |

| Subtotal Cash from Operations | $24,013 | $26,364 | $41,215 | $44,119 | $45,596 | $60,277 | $76,892 | $101,628 | $114,398 | $121,052 | $120,618 | $119,074 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $24,013 | $26,364 | $41,215 | $44,119 | $45,596 | $60,277 | $76,892 | $101,628 | $114,398 | $121,052 | $120,618 | $119,074 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $30,000 | $30,000 | |

| Bill Payments | $12,762 | $26,587 | $27,930 | $27,590 | $27,585 | $29,280 | $35,702 | $42,095 | $48,534 | $48,296 | $47,065 | $46,084 | |

| Subtotal Spent on Operations | $44,762 | $58,587 | $59,930 | $59,590 | $59,585 | $61,280 | $67,702 | $74,095 | $80,534 | $80,296 | $77,065 | $76,084 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $44,762 | $58,587 | $59,930 | $59,590 | $59,585 | $61,280 | $67,702 | $74,095 | $80,534 | $80,296 | $77,065 | $76,084 | |

| Net Cash Flow | ($20,749) | ($32,223) | ($18,714) | ($15,471) | ($13,989) | ($1,003) | $9,189 | $27,533 | $33,864 | $40,756 | $43,553 | $42,990 | |

| Cash Balance | $91,128 | $58,905 | $40,190 | $24,719 | $10,730 | $9,727 | $18,916 | $46,449 | $80,314 | $121,069 | $164,622 | $207,612 |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $111,877 | $91,128 | $58,905 | $40,190 | $24,719 | $10,730 | $9,727 | $18,916 | $46,449 | $80,314 | $121,069 | $164,622 | $207,612 |

| Accounts Receivable | $0 | $16,008 | $32,695 | $33,424 | $34,161 | $36,531 | $46,742 | $65,525 | $85,726 | $97,626 | $97,010 | $93,353 | $92,523 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $111,877 | $107,136 | $91,599 | $73,614 | $58,880 | $47,261 | $56,469 | $84,442 | $132,175 | $177,940 | $218,079 | $257,975 | $300,135 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $111,877 | $107,136 | $91,599 | $73,614 | $58,880 | $47,261 | $56,469 | $84,442 | $132,175 | $177,940 | $218,079 | $257,975 | $300,135 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $11,877 | $25,655 | $27,010 | $26,673 | $26,617 | $28,097 | $34,306 | $40,477 | $46,922 | $46,726 | $45,530 | $44,503 | $45,863 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $11,877 | $25,655 | $27,010 | $26,673 | $26,617 | $28,097 | $34,306 | $40,477 | $46,922 | $46,726 | $45,530 | $44,503 | $45,863 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $11,877 | $25,655 | $27,010 | $26,673 | $26,617 | $28,097 | $34,306 | $40,477 | $46,922 | $46,726 | $45,530 | $44,503 | $45,863 |

| Paid-in Capital | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 | $550,000 |

| Retained Earnings | ($450,000) | ($450,000) | ($450,000) | ($450,000) | ($450,000) | ($450,000) | ($450,000) | ($450,000) | ($450,000) | ($450,000) | ($450,000) | ($450,000) | ($450,000) |

| Earnings | $0 | ($18,519) | ($35,411) | ($53,059) | ($67,737) | ($80,836) | ($77,838) | ($56,035) | ($14,748) | $31,214 | $72,549 | $113,472 | $154,272 |

| Total Capital | $100,000 | $81,481 | $64,589 | $46,941 | $32,263 | $19,164 | $22,162 | $43,965 | $85,252 | $131,214 | $172,549 | $213,472 | $254,272 |

| Total Liabilities and Capital | $111,877 | $107,136 | $91,599 | $73,614 | $58,880 | $47,261 | $56,469 | $84,442 | $132,175 | $177,940 | $218,079 | $257,975 | $300,135 |

| Net Worth | $100,000 | $81,481 | $64,589 | $46,941 | $32,263 | $19,164 | $22,162 | $43,965 | $85,252 | $131,214 | $172,549 | $213,472 | $254,272 |