Advisory Consulting and Accounting Services: A Step-by-Step Method for Growth

Jump to

The accounting and consulting industries are changing rapidly, and your clients are turning to you for advice on their business growth challenges and opportunities.

That’s what advisory consulting is all about: your firm needs to be able to offer Strategic Advising services confidently and profitably.

What is Strategic Advising?

Strategic Advising is the analysis, forecasting, reporting and strategy needed for a business owner to survive and thrive. Think of it as outsourced management accounting. Small business owners need your help in understanding their metrics and applying that understanding to their operation to make strategic decisions, about things like hiring, firing, capital purchases, expansion, various expense benchmarks, and even new revenue streams.

You may be unsure how to offer these services or the technology you need to deliver them.

You need the work to be scalable. You need it to be profitable. You need it to be manageable.

Jumping to a technology solution first is tempting, and there are many solutions, but it’s best to start by implementing a business process. The process will guide your day-to-day strategic advisory consulting work and also define for you the technology and other resources you need, primarily skilled staff.

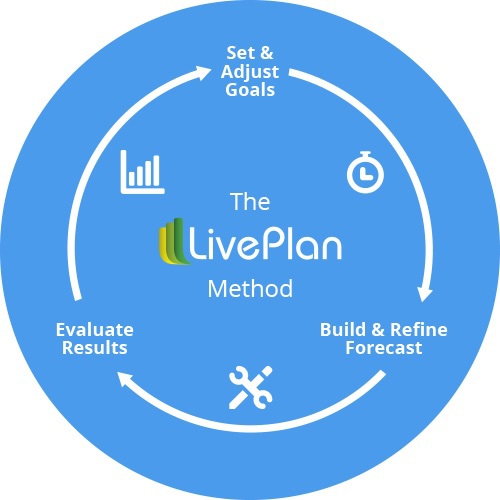

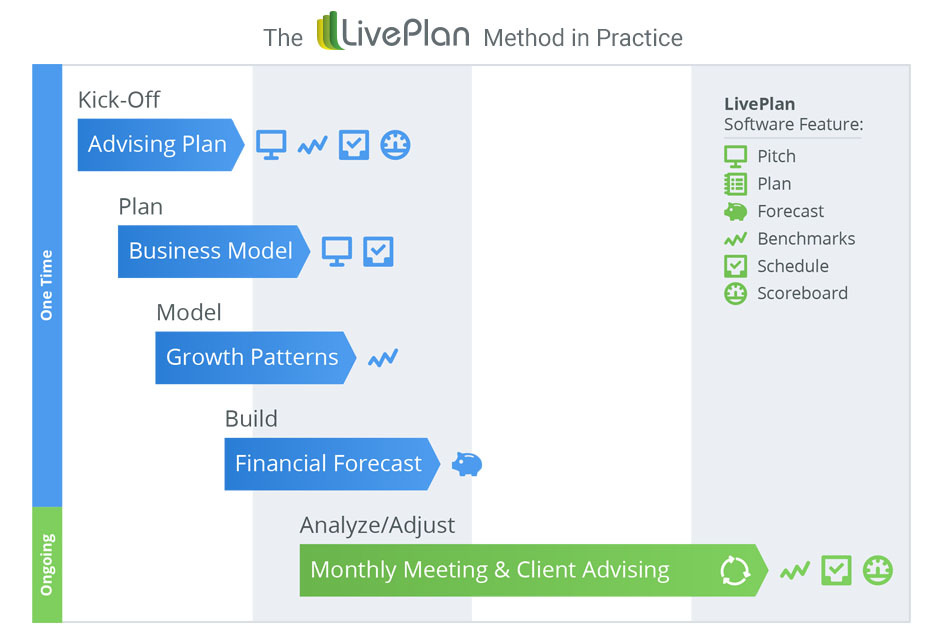

Within this post I offer a sample advisory business process, the LivePlan Method, which you can download and use, but I also want to cover the benefits of having a process, and how you can go about building one for yourself around other services you offer. Read on for the three key advantages that come with having a business process.

Your strategic advisory services are no longer limited to one industry

A well-designed business process can be industry agnostic, meaning that you can apply it across all types of small business clients, no matter their industry.

“Going niche,” as it’s come to be called, can be a strategic move for advisory firms, but you can also keep your practice open to many industries, assuming you set up efficient processes.

Keeping your target market more broad can help you determine your own growth path and remain diversified when markets change. In general, the more you can remain flexible with your customers, but rigid in scope of work, the better.

You can easily scale your advisory consulting business and remain profitable with established scope of services

You can only do so much in a month with each client, and the work you do must be profitable and therefore scalable.

Your overall strategic advisory consulting will of course be work that is fluid, but you can still keep this work to a scope that will allow you to scale, meaning complete all the work you need for all your clients, and still be profitable. Your scope for each client should be tied directly to your business process, and when you get it right, you can actually be more profitable, because as time goes on your work becomes more routine, and your monthly price stays fixed.

Your monthly business process should contain work tasks that deliver a reasonable amount of small business guidance each month—not everything possible, just enough. Be mindful that because advisory consulting and accounting work is so fluid, it is easy to get out of scope quickly.

Staying in control of your agenda and the metrics/operations you are analyzing each month is a way to stay in scope. There are 12 months in a year, and many, many more than that during the time you’ll be working with your clients—you don’t have to get it all done in the first month!

Services, or deliverables, beyond your engagement can be added at additional rates to your client. Creating a menu of additional services is ideal.

Your team can easily and seamlessly offer strategic advisory consulting services

An effective strategic advisory consulting process includes sales and engagement steps built-in, as tasks. This ensures that everyone in your practice is able to successfully engage with and sell strategic advising to clients in a comfortable way.

Your strategic advisory consulting service offering should be as natural for your staff to communicate to clients as any other offering, and the tasks help with that.

The LivePlan Method for Strategic Advising—a step-by-step process

The following is an overview of our strategic advising process, and here is a link to download our step by step resource guide.

Following this section is guidance on developing business processes for other work in your practice as well as some final words about growth and scale.

- Kick-offFrame your advisory relationship, learn your client’s broad business goal, and sell them on advisory. This is the time you set aside to connect with your client and model for them what an advisory relationship with you will look and feel like. In order for them to effectively engage with you, they have to know what to expect.

- PlanPerform Lean Planning with your client: what do they sell, who do they sell to, how do they sell, and who and what do they rely on to get that done? Here you are gathering the essential elements of their business model, in order to build a financial roadmap.

- ModelPerform a historical analysis of profit and loss and cash to establish a basis for forecast metrics. You cannot build a smart financial roadmap unless you do a bit of analysis. What has the business done in the recent past? Do they have a basis for the growth they wish to achieve?

- BuildBuild a full financial forecast: profit and loss, cash flow, and balance sheet. This will be used to manage the day to day operations of the business. Use the goals established in Lean Planning, and the historical analysis to build a smart roadmap.

- AdviseThis is your advisory monthly meeting, where you will review actual results against the forecast and address the business goals and related forecast.

Growing and scaling

Based on your own unique staff and your particular client base, you will find versions of the workflow that are the most profitable and best suited to your firm. It may be more transactional and reporting-focused. Or it may involve more planning and forecasting. The key though is to stay strict to your scope and charge extra for anything that falls outside of scope.

Developing your own best workflow for client advisory will happen over time, and that’s to be expected. You won’t get it perfect right out of the gate, but over the course of six to 12 months, you should expect to see a refinement of your process. If you’ve taken the time to implement a true task-based system, your business will benefit.

If you have questions about any of the subject matter contained in this article, please reach out to us at accountants@liveplan.com or consultants@liveplan.com. We are always happy to help advisors grow their practice.

More in Advisors and educators

advisors & educators

How to Sell Financial Advising Services to Accounting Clients

advisors & educators

The 14 Elements of a Dynamic Entrepreneurship Curriculum

advisors & educators

Financial Forecasting: The Best Practices in Strategic Advising

advisors & educators