Market Research

Market research without the overwhelm.

Fast, affordable insights to validate your market, understand competitors, and profile your customers. Powered by AI and built directly into your business plan.

Entrepreneurs face a tough choice with market research:

Do it yourself

Open endless browser tabs. Find conflicting data. Wonder which sources to trust. Spend days on research that still leaves you uncertain.

Hire it out

Pay $2,000+ for professional research. Wait weeks for deliverables. Get a report that might not integrate smoothly into your business plan.

Skip it (fake it)

Leave sections blank or fill in assumptions that "sound good." Present a plan you're not confident in defending.

But here’s the thing:

market research doesn’t have to be painful, expensive, or incomplete.

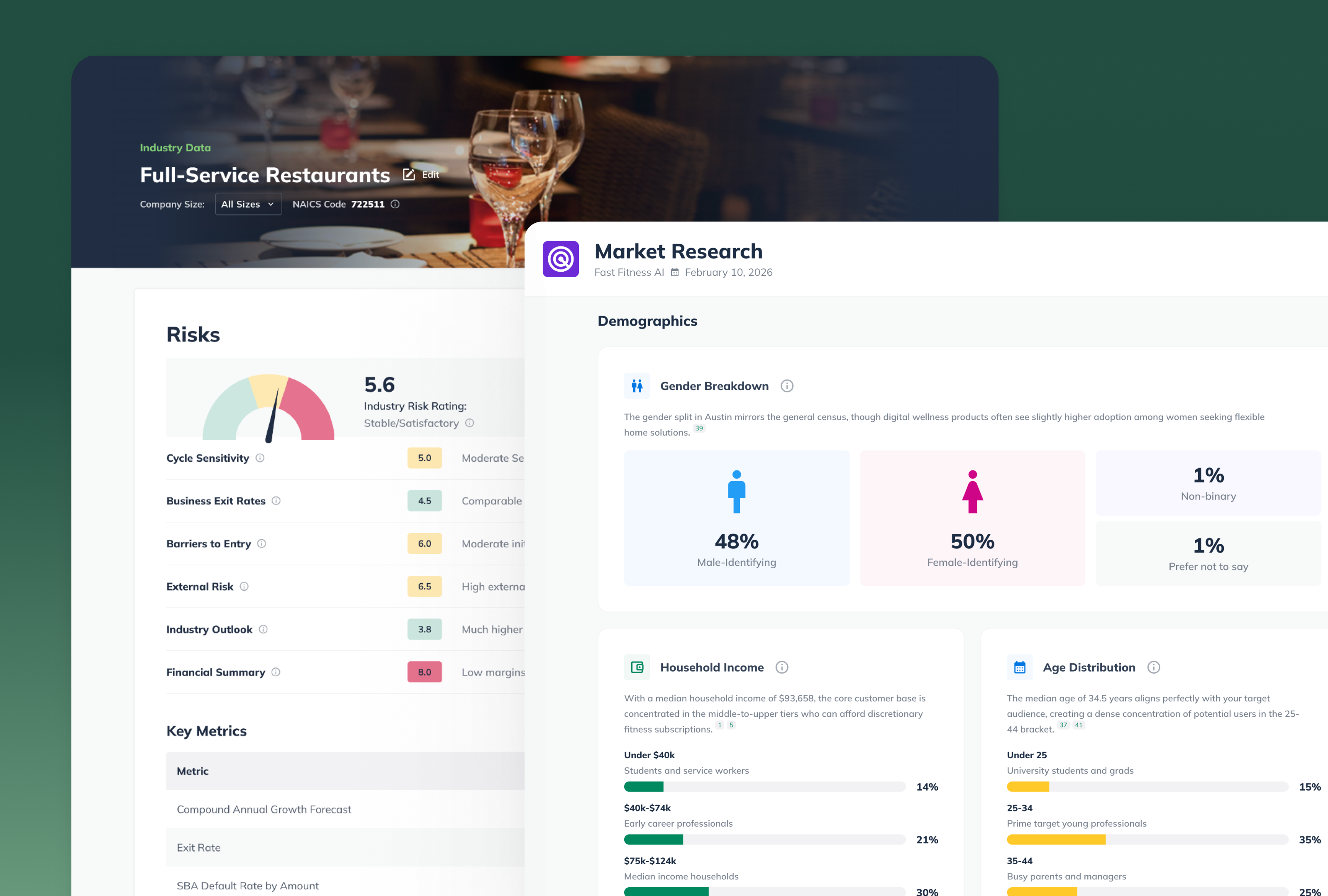

Market Size & Opportunity

Validate if you have a market

Stop guessing about who’s in your market and how large it is. Get clear data on your total addressable market, your audience demographics, and customer profiles specific to your industry and location. Use this data to set realistic financial projections and decide where to focus your marketing efforts.

Competitive Landscape

Know who you’re competing with

Get a focused analysis of your real competitive threats, how they're positioned, and where your advantages lie. This insight helps you set competitive pricing, sharpen your differentiation, and identify market gaps you can own.

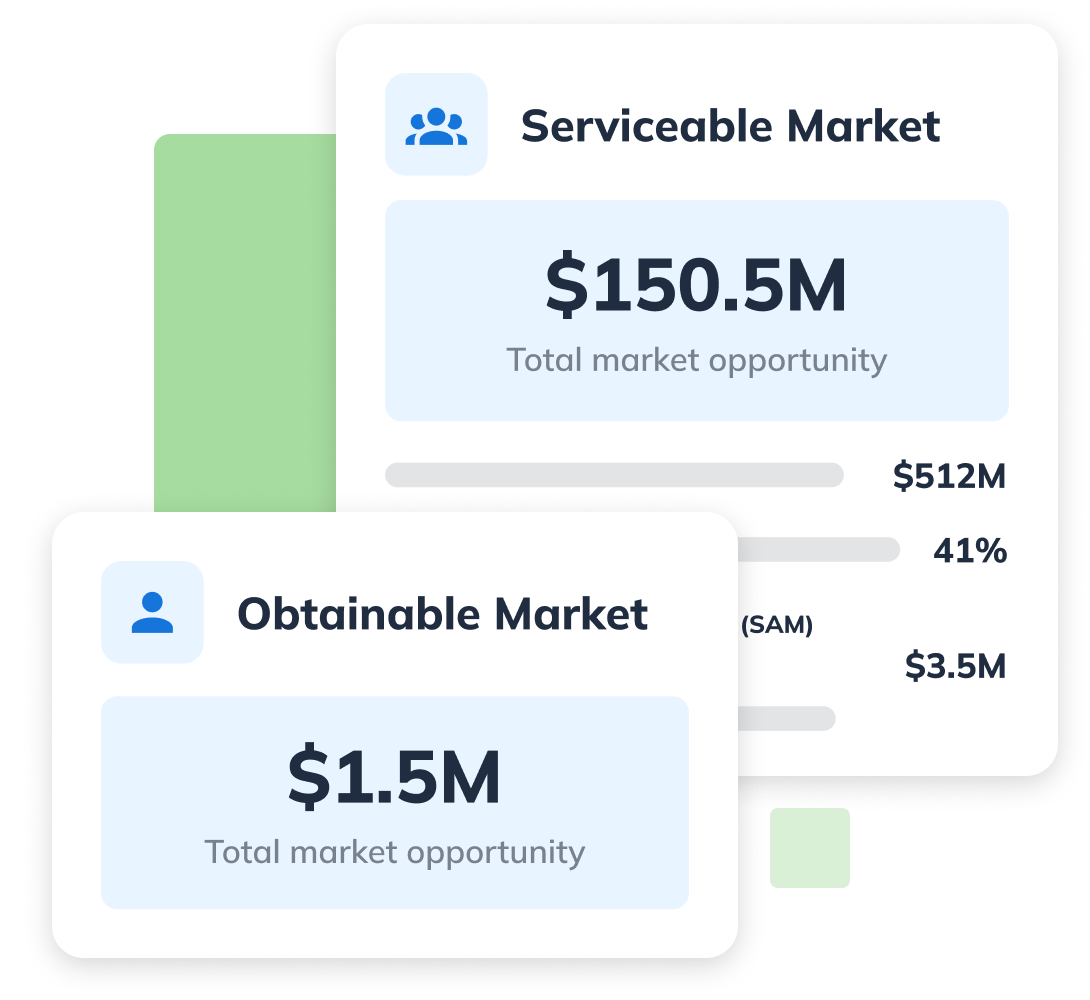

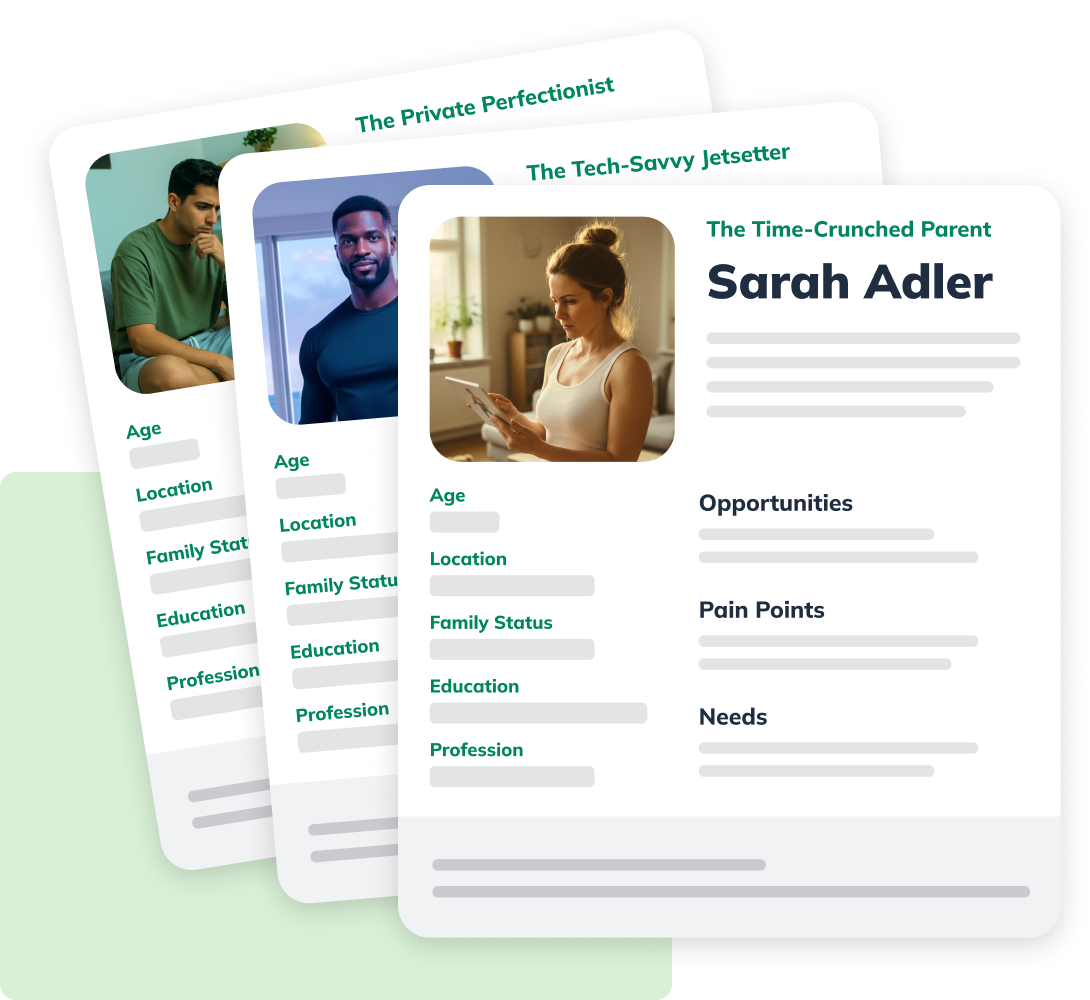

Customer Profiles

Understand who's actually buying

Replace vague assumptions with detailed customer or business profiles grounded in real data. See who your customers are, what they need, and how they behave - then use these insights to shape your marketing strategy, product decisions, and messaging. No more guessing who you're building for.

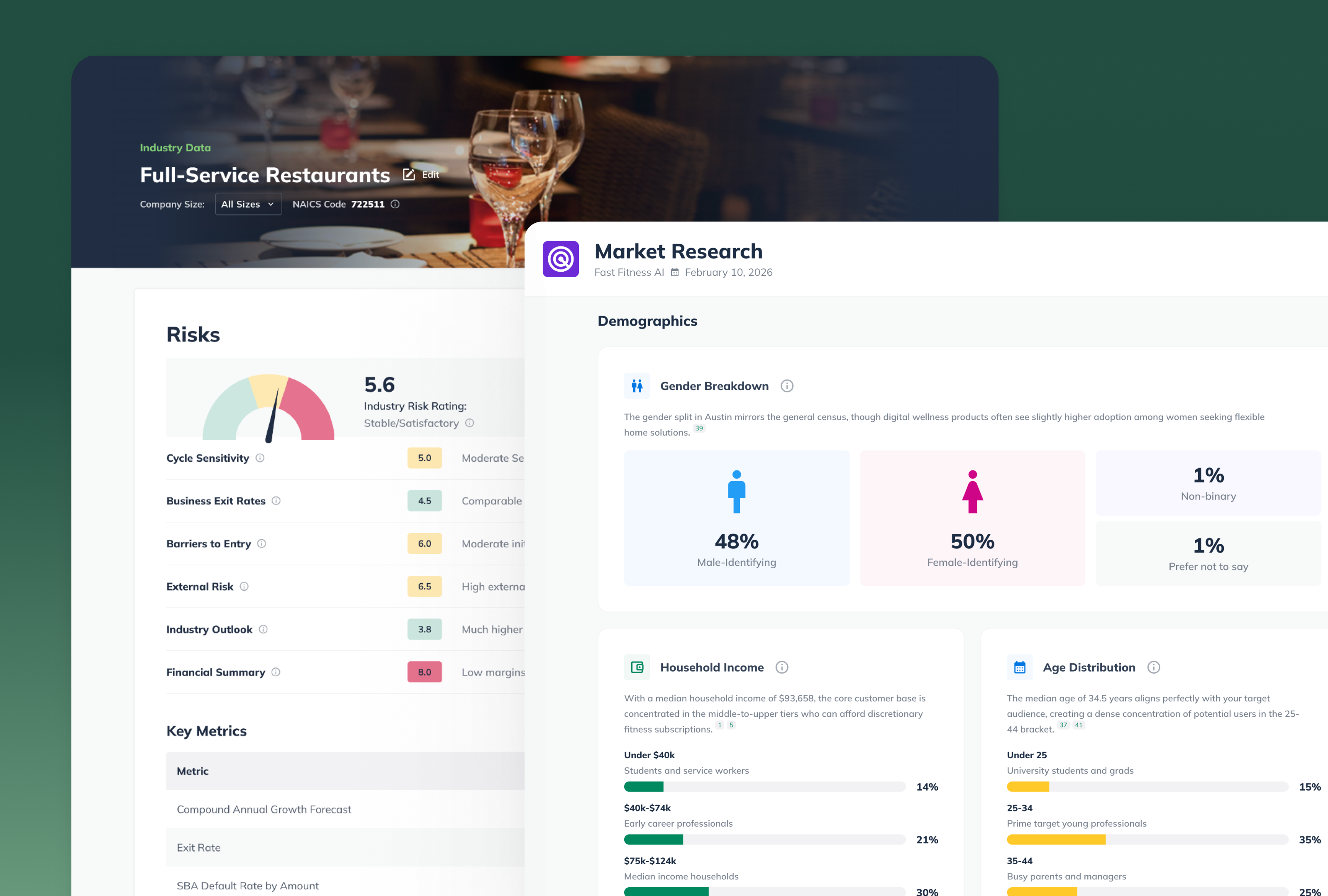

Industry Data & Benchmarks

Stay on top of industry trends

See how your industry performs, what benchmarks matter, and where trends are heading. Use industry financial metrics to set realistic targets for your own business and show lenders your projections are grounded in actual industry data.

Whether you’re starting or ready to scale…

If you’re validating your idea | If you’re seeking funding | If you’re planning for growth |

|---|---|---|

Make sure there's a market before you go all in | Market analysis that holds up to investor scrutiny | Expand based on data, not gut feeling |

Trusted by 850,000+ entrepreneurs worldwide

Frequently asked questions

LivePlan's market research covers the below, specific to your market:

Market Size & Opportunity

- TAM - Total Addressable Market

- SAM - Service Addressable Market

- SOM - Service Obtainable Market

Market Demographics/Firmographics

Depending on business type, LivePlan will show you demographic data of your market: age, gender, income, and education or firmographic data: industry, company size, revenue and location.

Target Audience

Highlight who your primary target is.

Customer Personas

Highlight various personifications of your target audience, including their pain points, needs, and values.

Trends & Behaviors

- Market risks

- Market growth

- Buying Behaviors

Competitive Analysis

An overview of your competitors, their strengths and weaknesses, price points, and positioning.

LivePlan Premium includes our Market Research feature.

Any geography as long as there is publicly available data for that region.

Any business type, including B2B and B2C businesses.

Our AI tries to get data from the past 2 years and if prompted, the report can be refreshed as needed.

For completely unique businesses where the market is not established yet, the tool may struggle to find relevant resources.

All resources it uses are publicly available on the internet. It can not source content that is behind paywalls or is otherwise private.

LivePlan Premium gives you access to both industry and market research. Industry research analyzes the broader market landscape, including trends and growth potential, whereas market research focuses on understanding specific customer needs, behaviors, and preferences. While industry research examines the macro environment (suppliers, regulation), market research focuses on micro-level buyer behavior to inform product development and marketing strategies.

LivePlan's industry research covers roughly 97% of GDP/industries. LivePlan's industry benchmarks cover metrics such as:

Profit Metrics

- Gross Margin

- Operating Margin

- Net Profit Margin

Cash Metrics

- Average days to get paid

- Average days to pay

- Inventory on hand

Productivity Metrics

- Monthly revenue per employee

- Monthly net profit per employee

Spending Metrics

- Revenue spent on rent

- Revenue spent on marketing

- Revenue spent on payroll

Other Metrics

- Quick ratio

- Current ratio

LivePlan's industry data is provided by VerticalIQ.

Industry research is a systematic process of collecting, analyzing, and interpreting data about a specific industry sector. It should include an examination of market trends, competitive landscapes, and economic factors affecting a particular business area. It provides businesses with a tool for understanding industry-specific metrics, benchmarks, and best practices.

Industry research is not a guarantee of business success or a substitute for sound business strategy, nor is it a one-time activity. Industry research requires ongoing updates to remain relevant and should not focus exclusively on a single company's performance or internal data.

Industry research should also not replace your primary research, including statistical data, qualitative insights, or direct customer feedback.

Industry research is vital for small business owners as it empowers them to make informed decisions backed by data rather than assumptions. It provides crucial insights into market trends, customer behaviors, and competitive landscapes, enabling owners to identify opportunities and mitigate risks. This knowledge helps in setting realistic goals, optimizing operations, and allocating resources effectively.

By understanding industry benchmarks and best practices, small businesses can improve their financial planning, enhance their credibility with stakeholders, and gain a competitive edge. Ultimately, industry research equips small business owners with the tools to adapt to market changes, capitalize on emerging trends, and make strategic decisions that drive growth and sustainability in their specific business sector.