Convenience Store Gas Station Business Plan

Allensburg's Food and Gas

Executive Summary

Allensburg is a small town with a population 3,400. Located on rural Highway 310, the town is 30 miles south of the city of Kent and 34 miles north of the city of Willard. Highway 310 connects Kent and Willard that both have universities and a cumulative population of 200,000 residents. The highway is the main road through town and is used daily by thousands of commuters between the two cities. These commuters sustain a number of road side businesses on Highway 310 that sell flowers, produce and bakery products.

In order to get gas in the Allensburg area, commuters currently have to leave the highway and drive three miles into the edge of town. Robert Cole, the owner of Allensburg’s Food and Gas has the opportunity to rent a plot of land just off the Allensburg exit of Highway 310.

Allensburg’s Food and Gas will offer these commuters gas, organic produce, and a deli. On the way to work, a commuter could stop for gas and pick up a sandwich. On the way home, the same commuter could stop again to pick up something for dinner.

The aim of this plan is to be a guide for this start-up business. Researching and defining our markets, strategies, mission and financials will provide insight and prepare the owner to successfully run Allensburg’s Food and Gas.

1.1 Objectives

- To capture an increasing share of the commuter traffic passing through Allensburg.

- To offer our customers superior products, at an affordable price.

- To provide customer service that is second to none.

Need real financials? Explore a spreadsheet-free path to generating financial data for your business. Create your own business plan

1.2 Mission

The mission of Allensburg’s Food and Gas is to offer commuters on Highway 310 competitive gas prices and great food. The company will make a healthy profit for its owners and provide a rewarding work environment for its employees.

1.3 Keys to Success

- Good quality products at competitive prices.

- Excellent customer service that will promote customer loyalty.

- A location that will assure that commuters will stop.

Company Summary

Allensburg’s Food and Gas is a new convenience store and gas station in Allensburg. Robert Cole, owner of Allensburg’s Food and Gas, has seven years of experience in managing gas stations. Robert will focus on the commuters that pass through the town daily. Allensburg’s Food and Gas will offer its customers the best gas prices and quality food products.

2.1 Company Ownership

Allensburg’s Food and Gas is wholly owned by Robert Cole.

2.2 Start-up Summary

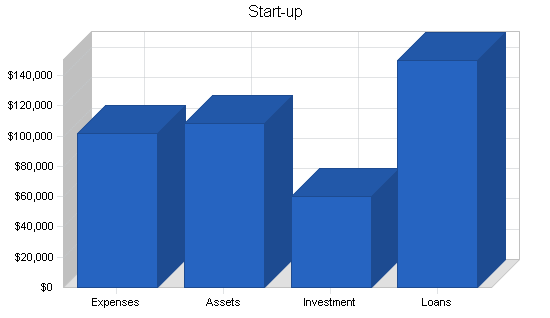

Robert Cole will invest $60,000 in Allensburg’s Food and Gas. Robert aims to secure an SBA of $150,000 to finance the remainder of the start up costs.

The following chart and table show projected initial start-up costs for Allensburg’s Food and Gas.

Need real milestones? We recommend using LivePlan as the easiest way to create milestones for your own business plan. Create your own business plan

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $1,000 |

| Insurance | $1,000 |

| Rent | $1,500 |

| State Permits | $3,000 |

| Gas Station Setup | $70,000 |

| Store Setup | $20,000 |

| Promotional Sign | $5,000 |

| Total Start-up Expenses | $101,500 |

| Start-up Assets | |

| Cash Required | $18,500 |

| Start-up Inventory | $10,000 |

| Other Current Assets | $0 |

| Long-term Assets | $80,000 |

| Total Assets | $108,500 |

| Total Requirements | $210,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $101,500 |

| Start-up Assets to Fund | $108,500 |

| Total Funding Required | $210,000 |

| Assets | |

| Non-cash Assets from Start-up | $90,000 |

| Cash Requirements from Start-up | $18,500 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $18,500 |

| Total Assets | $108,500 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $150,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $150,000 |

| Capital | |

| Planned Investment | |

| Robert Cole | $60,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $60,000 |

| Loss at Start-up (Start-up Expenses) | ($101,500) |

| Total Capital | ($41,500) |

| Total Capital and Liabilities | $108,500 |

| Total Funding | $210,000 |

Products

Allensburg’s Food and Gas sells the following products:

- Gasoline and diesel fuel;

- Oil, de-icer, car accessories, etc.;

- Deli items;

- Drinks;

- Bakery goods;

- Organic produce.

Market Analysis Summary

Located on rural Highway 310, Allensburg is 30 miles south of the city of Kent and 34 miles north of the city of Willard. Highway 310 connects Kent and Willard that both have universities and a cumulative population of 200,000 residents. The highway is the main road through town and is used daily by thousands of commuters between the two cities. The closest gas station in either direction is over 20 miles away.

These commuters currently have no convenient shop in which to buy food to or from work once they are on Highway 310; more importantly, eighty percent of Highway 310 commuters fits the demographic profile of customers of upscale organic/natural food stores:

- Age: 25 – 45 years of age;

- Gender: 60% women;

- Average income: $40,000+;

- Education: college graduate;

- Employment: professionals in business and education.

4.1 Market Segmentation

The target customers of Allensburg’s Food and Gas are the commuters that use Highway 310.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Commuters | 10% | 5,500 | 6,050 | 6,655 | 7,321 | 8,053 | 10.00% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 10.00% | 5,500 | 6,050 | 6,655 | 7,321 | 8,053 | 10.00% |

Strategy and Implementation Summary

Allensburg’s Food and Gas will focus on becoming a routine stop for the commuter traffic on Highway 310, not just for those people who need gas, but for those who are looking for a healthy, tasty snack on their drive, or need to pick up some small grocery item on their way home. Allensburg’s Food and Gas will aim to be more than a gas station to its customers, it will be a friendly place to stop for tired commuters.

5.1 Competitive Edge

The competitive edge for Allensburg’s Food and Gas is the following:

- Location:Allensburg’s Food and Gas is located on Highway 310. The closest competitor is three miles into the town of Allensburg.

- Quality Deli and Organic Produce: While buying gas, commuters will now be able to pick up lunch, or buy something to take home. The commuter will soon regard Allensburg’s Food and Gas as an invaluable time saver in their day.

To develop good business strategies, perform a SWOT analysis of your business. It's easy with our free guide and template.Learn how to perform a SWOT analysis

5.2 Sales Strategy

Allensburg’s Food and Gas will keep its gas prices competitive with other stations in a fifty mile radius of the station in order to attract commuters. Customers that purchase more than $10 worth of gas will be given 15% coupon on purchases in the store during the first month of operation, to encourage purchases and to introduce them to the concept of buying quality organic foods at the gas station.

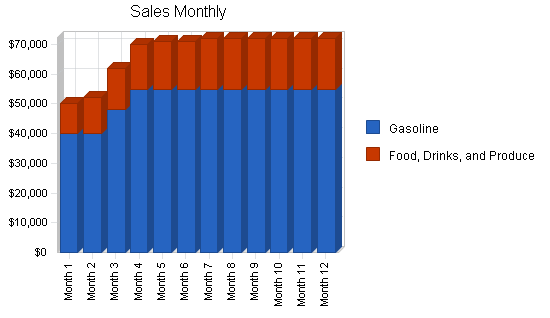

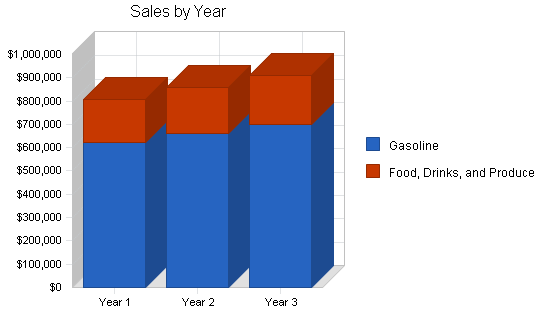

5.2.1 Sales Forecast

In order to maintain competitive gas prices, the cost of gas to the consumer will never exceed 15% of wholesale cost. Allensburg’s Food and Gas will focus on increasing food sales in order to meet total sales forecast goals.

The following is the sales forecast for three years.

Need impressive charts? Discover the simplest way to create detailed graphs for your business plan. Create your own business plan

Need real milestones? Establish a clear path for your business with real-world examples. Create your own business plan

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Gasoline | $623,000 | $660,000 | $700,000 |

| Food, Drinks, and Produce | $185,000 | $198,000 | $210,000 |

| Total Sales | $808,000 | $858,000 | $910,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Gasoline | $544,000 | $570,000 | $582,000 |

| Food, Drinks, and Produce | $37,200 | $41,000 | $44,500 |

| Subtotal Direct Cost of Sales | $581,200 | $611,000 | $626,500 |

Management Summary

Robert Cole, owner of Allensburg’s Food and Gas, has seven years of experience in managing gas stations/convenience stores. Robert has a reputation as an excellent staff supervisor. From 1993 to 1996, Robert was the manager of Higgins Texaco, one of the largest gas station/convenience stores in Willard. At Higgins, Robert supervised a staff of seven. In 1997, Robert became manager of the Barger Chevron, located at the southern tip of Kent, near Highway 310.

6.1 Personnel Plan

The Allensburg Food and Gas will have a staff of five:

- Manager

- Store/deli staff (2)

- Gas attendants (2)

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Robert Cole | $33,600 | $37,000 | $40,000 |

| Store/Deli Staff | $42,000 | $44,000 | $46,000 |

| Gas Attendants | $42,000 | $44,000 | $46,000 |

| Total People | 5 | 5 | 5 |

| Total Payroll | $117,600 | $125,000 | $132,000 |

Financial Plan

The following is the financial plan for Allensburg’s Food and Gas.

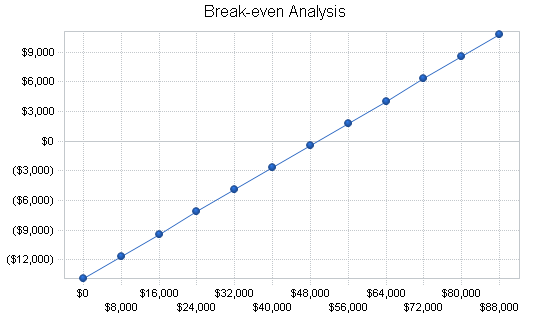

7.1 Break-even Analysis

The monthly break-even point is approximately $49,500.

Need impressive charts? Discover the simplest way to create detailed graphs for your business plan. Create your own business plan

| Break-even Analysis | |

| Monthly Revenue Break-even | $49,539 |

| Assumptions: | |

| Average Percent Variable Cost | 72% |

| Estimated Monthly Fixed Cost | $13,905 |

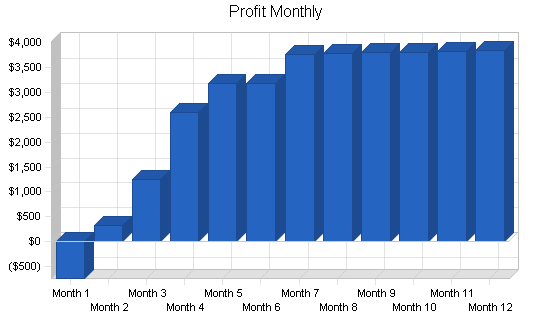

7.2 Projected Profit and Loss

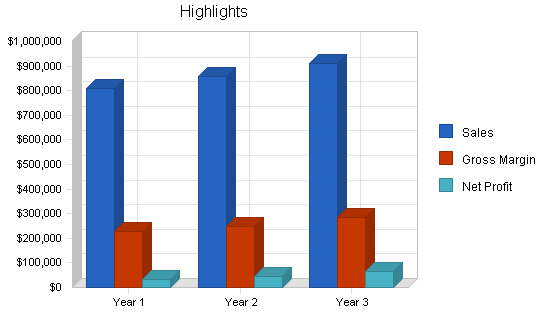

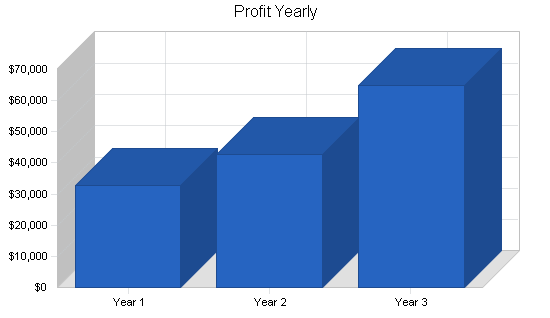

The following table and charts highlight the projected profit and loss for three years.

Need real milestones? Establish a clear path for your business with real-world examples. Create your own business plan

Need real milestones? We recommend using LivePlan as the easiest way to create milestones for your own business plan. Create your own business plan

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $808,000 | $858,000 | $910,000 |

| Direct Cost of Sales | $581,200 | $611,000 | $626,500 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $581,200 | $611,000 | $626,500 |

| Gross Margin | $226,800 | $247,000 | $283,500 |

| Gross Margin % | 28.07% | 28.79% | 31.15% |

| Expenses | |||

| Payroll | $117,600 | $125,000 | $132,000 |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 |

| Depreciation | $11,424 | $11,424 | $11,424 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $3,600 | $3,600 | $3,600 |

| Insurance | $3,600 | $3,600 | $3,600 |

| Rent | $13,000 | $13,000 | $13,000 |

| Payroll Taxes | $17,640 | $18,750 | $19,800 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $166,864 | $175,374 | $183,424 |

| Profit Before Interest and Taxes | $59,936 | $71,626 | $100,076 |

| EBITDA | $71,360 | $83,050 | $111,500 |

| Interest Expense | $13,375 | $10,500 | $7,500 |

| Taxes Incurred | $13,968 | $18,338 | $27,773 |

| Net Profit | $32,593 | $42,788 | $64,803 |

| Net Profit/Sales | 4.03% | 4.99% | 7.12% |

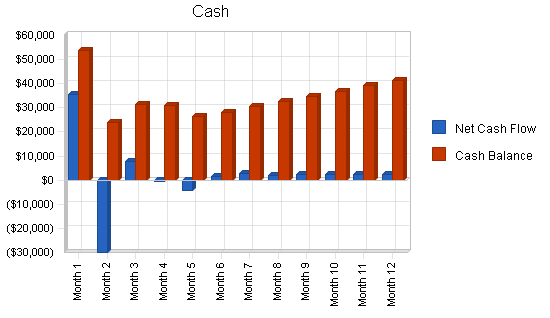

7.3 Projected Cash Flow

The following table and chart highlight the projected cash flow for three years.

Need real financials? Explore a spreadsheet-free path to generating financial data for your business. Create your own business plan

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $808,000 | $858,000 | $910,000 |

| Subtotal Cash from Operations | $808,000 | $858,000 | $910,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $808,000 | $858,000 | $910,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $117,600 | $125,000 | $132,000 |

| Bill Payments | $637,424 | $681,157 | $701,506 |

| Subtotal Spent on Operations | $755,024 | $806,157 | $833,506 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $30,000 | $30,000 | $30,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $785,024 | $836,157 | $863,506 |

| Net Cash Flow | $22,976 | $21,843 | $46,494 |

| Cash Balance | $41,476 | $63,319 | $109,813 |

7.4 Projected Balance Sheet

The following table and chart highlight the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $41,476 | $63,319 | $109,813 |

| Inventory | $56,540 | $59,439 | $60,947 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $98,016 | $122,758 | $170,760 |

| Long-term Assets | |||

| Long-term Assets | $80,000 | $80,000 | $80,000 |

| Accumulated Depreciation | $11,424 | $22,848 | $34,272 |

| Total Long-term Assets | $68,576 | $57,152 | $45,728 |

| Total Assets | $166,592 | $179,910 | $216,488 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $55,500 | $56,029 | $57,804 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $55,500 | $56,029 | $57,804 |

| Long-term Liabilities | $120,000 | $90,000 | $60,000 |

| Total Liabilities | $175,500 | $146,029 | $117,804 |

| Paid-in Capital | $60,000 | $60,000 | $60,000 |

| Retained Earnings | ($101,500) | ($68,907) | ($26,119) |

| Earnings | $32,593 | $42,788 | $64,803 |

| Total Capital | ($8,907) | $33,881 | $98,684 |

| Total Liabilities and Capital | $166,592 | $179,910 | $216,488 |

| Net Worth | ($8,907) | $33,881 | $98,684 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 5541, Gasoline Service Station, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 6.19% | 6.06% | 10.80% |

| Percent of Total Assets | ||||

| Inventory | 33.94% | 33.04% | 28.15% | 13.30% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 25.60% |

| Total Current Assets | 58.84% | 68.23% | 78.88% | 49.50% |

| Long-term Assets | 41.16% | 31.77% | 21.12% | 50.50% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 33.31% | 31.14% | 26.70% | 31.60% |

| Long-term Liabilities | 72.03% | 50.03% | 27.72% | 23.10% |

| Total Liabilities | 105.35% | 81.17% | 54.42% | 54.70% |

| Net Worth | -5.35% | 18.83% | 45.58% | 45.30% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 28.07% | 28.79% | 31.15% | 16.50% |

| Selling, General & Administrative Expenses | 24.04% | 23.80% | 24.03% | 10.40% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.20% |

| Profit Before Interest and Taxes | 7.42% | 8.35% | 11.00% | 0.50% |

| Main Ratios | ||||

| Current | 1.77 | 2.19 | 2.95 | 1.55 |

| Quick | 0.75 | 1.13 | 1.90 | 0.91 |

| Total Debt to Total Assets | 105.35% | 81.17% | 54.42% | 54.70% |

| Pre-tax Return on Net Worth | -522.73% | 180.41% | 93.81% | 2.50% |

| Pre-tax Return on Assets | 27.95% | 33.98% | 42.76% | 5.50% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 4.03% | 4.99% | 7.12% | n.a |

| Return on Equity | 0.00% | 126.29% | 65.67% | n.a |

| Activity Ratios | ||||

| Inventory Turnover | 10.91 | 10.54 | 10.41 | n.a |

| Accounts Payable Turnover | 12.49 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 30 | 30 | n.a |

| Total Asset Turnover | 4.85 | 4.77 | 4.20 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.00 | 4.31 | 1.19 | n.a |

| Current Liab. to Liab. | 0.32 | 0.38 | 0.49 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $42,517 | $66,729 | $112,956 | n.a |

| Interest Coverage | 4.48 | 6.82 | 13.34 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.21 | 0.21 | 0.24 | n.a |

| Current Debt/Total Assets | 33% | 31% | 27% | n.a |

| Acid Test | 0.75 | 1.13 | 1.90 | n.a |

| Sales/Net Worth | 0.00 | 25.32 | 9.22 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Gasoline | 0% | $40,000 | $40,000 | $48,000 | $55,000 | $55,000 | $55,000 | $55,000 | $55,000 | $55,000 | $55,000 | $55,000 | $55,000 |

| Food, Drinks, and Produce | 0% | $10,000 | $12,000 | $14,000 | $15,000 | $16,000 | $16,000 | $17,000 | $17,000 | $17,000 | $17,000 | $17,000 | $17,000 |

| Total Sales | $50,000 | $52,000 | $62,000 | $70,000 | $71,000 | $71,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Gasoline | $35,000 | $35,000 | $42,000 | $48,000 | $48,000 | $48,000 | $48,000 | $48,000 | $48,000 | $48,000 | $48,000 | $48,000 | |

| Food, Drinks, and Produce | $2,000 | $2,500 | $2,900 | $3,000 | $3,200 | $3,200 | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | |

| Subtotal Direct Cost of Sales | $37,000 | $37,500 | $44,900 | $51,000 | $51,200 | $51,200 | $51,400 | $51,400 | $51,400 | $51,400 | $51,400 | $51,400 |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Robert Cole | 0% | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 |

| Store/Deli Staff | 0% | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Gas Attendants | 0% | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Total People | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | |

| Total Payroll | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $50,000 | $52,000 | $62,000 | $70,000 | $71,000 | $71,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | |

| Direct Cost of Sales | $37,000 | $37,500 | $44,900 | $51,000 | $51,200 | $51,200 | $51,400 | $51,400 | $51,400 | $51,400 | $51,400 | $51,400 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $37,000 | $37,500 | $44,900 | $51,000 | $51,200 | $51,200 | $51,400 | $51,400 | $51,400 | $51,400 | $51,400 | $51,400 | |

| Gross Margin | $13,000 | $14,500 | $17,100 | $19,000 | $19,800 | $19,800 | $20,600 | $20,600 | $20,600 | $20,600 | $20,600 | $20,600 | |

| Gross Margin % | 26.00% | 27.88% | 27.58% | 27.14% | 27.89% | 27.89% | 28.61% | 28.61% | 28.61% | 28.61% | 28.61% | 28.61% | |

| Expenses | |||||||||||||

| Payroll | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Depreciation | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | $952 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Insurance | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Rent | $0 | $0 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | |

| Payroll Taxes | 15% | $1,470 | $1,470 | $1,470 | $1,470 | $1,470 | $1,470 | $1,470 | $1,470 | $1,470 | $1,470 | $1,470 | $1,470 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $12,822 | $12,822 | $14,122 | $14,122 | $14,122 | $14,122 | $14,122 | $14,122 | $14,122 | $14,122 | $14,122 | $14,122 | |

| Profit Before Interest and Taxes | $178 | $1,678 | $2,978 | $4,878 | $5,678 | $5,678 | $6,478 | $6,478 | $6,478 | $6,478 | $6,478 | $6,478 | |

| EBITDA | $1,130 | $2,630 | $3,930 | $5,830 | $6,630 | $6,630 | $7,430 | $7,430 | $7,430 | $7,430 | $7,430 | $7,430 | |

| Interest Expense | $1,229 | $1,208 | $1,188 | $1,167 | $1,146 | $1,125 | $1,104 | $1,083 | $1,063 | $1,042 | $1,021 | $1,000 | |

| Taxes Incurred | ($315) | $141 | $537 | $1,113 | $1,360 | $1,366 | $1,612 | $1,618 | $1,625 | $1,631 | $1,637 | $1,643 | |

| Net Profit | ($736) | $329 | $1,253 | $2,598 | $3,173 | $3,187 | $3,762 | $3,776 | $3,791 | $3,805 | $3,820 | $3,835 | |

| Net Profit/Sales | -1.47% | 0.63% | 2.02% | 3.71% | 4.47% | 4.49% | 5.22% | 5.24% | 5.27% | 5.29% | 5.31% | 5.33% |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $50,000 | $52,000 | $62,000 | $70,000 | $71,000 | $71,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | |

| Subtotal Cash from Operations | $50,000 | $52,000 | $62,000 | $70,000 | $71,000 | $71,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $50,000 | $52,000 | $62,000 | $70,000 | $71,000 | $71,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | $72,000 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | $9,800 | |

| Bill Payments | $2,356 | $69,710 | $42,025 | $58,309 | $63,158 | $57,288 | $57,082 | $57,698 | $57,471 | $57,457 | $57,442 | $57,427 | |

| Subtotal Spent on Operations | $12,156 | $79,510 | $51,825 | $68,109 | $72,958 | $67,088 | $66,882 | $67,498 | $67,271 | $67,257 | $67,242 | $67,227 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $14,656 | $82,010 | $54,325 | $70,609 | $75,458 | $69,588 | $69,382 | $69,998 | $69,771 | $69,757 | $69,742 | $69,727 | |

| Net Cash Flow | $35,344 | ($30,010) | $7,675 | ($609) | ($4,458) | $1,412 | $2,618 | $2,002 | $2,229 | $2,243 | $2,258 | $2,273 | |

| Cash Balance | $53,844 | $23,834 | $31,509 | $30,900 | $26,442 | $27,855 | $30,472 | $32,474 | $34,703 | $36,946 | $39,204 | $41,476 |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $18,500 | $53,844 | $23,834 | $31,509 | $30,900 | $26,442 | $27,855 | $30,472 | $32,474 | $34,703 | $36,946 | $39,204 | $41,476 |

| Inventory | $10,000 | $40,700 | $41,250 | $49,390 | $56,100 | $56,320 | $56,320 | $56,540 | $56,540 | $56,540 | $56,540 | $56,540 | $56,540 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $28,500 | $94,544 | $65,084 | $80,899 | $87,000 | $82,762 | $84,175 | $87,012 | $89,014 | $91,243 | $93,486 | $95,744 | $98,016 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 |

| Accumulated Depreciation | $0 | $952 | $1,904 | $2,856 | $3,808 | $4,760 | $5,712 | $6,664 | $7,616 | $8,568 | $9,520 | $10,472 | $11,424 |

| Total Long-term Assets | $80,000 | $79,048 | $78,096 | $77,144 | $76,192 | $75,240 | $74,288 | $73,336 | $72,384 | $71,432 | $70,480 | $69,528 | $68,576 |

| Total Assets | $108,500 | $173,592 | $143,180 | $158,043 | $163,192 | $158,002 | $158,463 | $160,348 | $161,398 | $162,675 | $163,966 | $165,272 | $166,592 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $68,328 | $40,087 | $56,197 | $61,248 | $55,386 | $55,159 | $55,783 | $55,556 | $55,542 | $55,528 | $55,514 | $55,500 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $68,328 | $40,087 | $56,197 | $61,248 | $55,386 | $55,159 | $55,783 | $55,556 | $55,542 | $55,528 | $55,514 | $55,500 |

| Long-term Liabilities | $150,000 | $147,500 | $145,000 | $142,500 | $140,000 | $137,500 | $135,000 | $132,500 | $130,000 | $127,500 | $125,000 | $122,500 | $120,000 |

| Total Liabilities | $150,000 | $215,828 | $185,087 | $198,697 | $201,248 | $192,886 | $190,159 | $188,283 | $185,556 | $183,042 | $180,528 | $178,014 | $175,500 |

| Paid-in Capital | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 |

| Retained Earnings | ($101,500) | ($101,500) | ($101,500) | ($101,500) | ($101,500) | ($101,500) | ($101,500) | ($101,500) | ($101,500) | ($101,500) | ($101,500) | ($101,500) | ($101,500) |

| Earnings | $0 | ($736) | ($407) | $846 | $3,444 | $6,617 | $9,804 | $13,566 | $17,342 | $21,133 | $24,938 | $28,758 | $32,593 |

| Total Capital | ($41,500) | ($42,236) | ($41,907) | ($40,654) | ($38,056) | ($34,883) | ($31,696) | ($27,934) | ($24,158) | ($20,367) | ($16,562) | ($12,742) | ($8,907) |

| Total Liabilities and Capital | $108,500 | $173,592 | $143,180 | $158,043 | $163,192 | $158,002 | $158,463 | $160,348 | $161,398 | $162,675 | $163,966 | $165,272 | $166,592 |

| Net Worth | ($41,500) | ($42,236) | ($41,907) | ($40,654) | ($38,056) | ($34,883) | ($31,696) | ($27,934) | ($24,158) | ($20,367) | ($16,562) | ($12,742) | ($8,907) |