What is Accounts Payable (AP)? [Definition + 4 Ways to Reduce]

Jump to

What is accounts payable?How to calculate accounts payableWhen should something be included in accounts payable?Examples of accounts payableWhy is accounts payable important?What’s better? Higher or lower accounts payable?How to reduce your accounts payableWhere to find accounts payable in LivePlanTrack accounts payable to help manage cash flowFAQWhen your business gets a bill in the mail, what happens? Do you pay it immediately, or do you maybe hold onto that bill for a little while before you pay it?

If you run your business like I run mine, you probably hold on to that bill and pay it toward the end of the month.

Sometimes—and this is perfectly normal—you might even delay payment on a bill while you wait for your customers to pay you.

Like most businesses, you might have more cash to pay bills at certain times of the month, and less flexibility at other times. If this sounds like you, don’t worry—you’re not alone!

All of those unpaid bills have a name: accounts payable.

What is accounts payable?

Accounts payable (AP) also known as “payables,” is the amount of money that you owe to your vendors and suppliers. Essentially, it’s a total of all the invoices that you have received but that you haven’t paid yet.

Accounts payable is considered short-term debt and may include things like:

- Rent

- Utilities

- Transportation and logistics

- Inventory or raw materials

- Services

And anything else associated with running your business month to month.

Your total accounts payable balance, for a specific point in time, will appear on your balance sheet as a current liability.

Other use of the accounts payable term

While not relevant to most small businesses, AP can sometimes refer to the accounts payable department. This is a specific team, typically in larger organizations, that make payments owed by the company to suppliers and creditors.

How to calculate accounts payable

Determining your accounts payable balance is fairly simple.

- Start with your accounts payable balance from the previous month (found on your balance sheet).

- Add any new invoices received and other purchases made on credit.

- Subtract any cash payments made over the same period.

Accounts Payable = Beginning AP Balance + (Total Purchases on Credit − Cash Payments Made to Suppliers)

This will provide you with an ending accounts payable balance for the month, which will carry over into the next month as your starting balance.

What is the accounts payable turnover ratio and how to calculate

Tracking your accounts payable turnover ratio helps you know how frequently you pay your bills.

Accounts Payable Turnover Ratio = Total Purchases ÷ Average Accounts Payable

As you grow your business, tracking this number will help you see if your business is paying its bills faster over time or slowing down.

When should something be included in accounts payable?

Ideally, you should keep your business’s financial books organized and enter your bills into your accounting system as they arrive.

Depending on the software you use, there may even be ways to create an accounts payable automation that immediately processes invoices and adds purchases to your AP.

This doesn’t mean you have to pay your bills right away, but it helps you keep track of who you owe and what your liabilities are.

You can also get reports from your accounting system (or right in LivePlan if you use the Performance Dashboard feature) that tell you the average amount of time it takes you to pay your bills—AP days—and which vendors you typically wait the longest to pay.

Examples of accounts payable

While accounts payable functions exactly the same for every business, the specific terms and timeline will be unique to each product and service purchased on credit.

Here are a few accounts payable examples you may come across:

Retail Store Ordering Inventory:

A local clothing store orders $10,000 in seasonal inventory from a wholesale supplier, with 30 days to pay, and the option to receive a 5% discount if paid within 10 days.

Office Equipment Lease:

A marketing agency leases office equipment for $500 per month, and the invoice is due in 15 days.

Freelancer or Contractor Services:

A software company hires a freelance graphic designer for a $2,000 project, with payment due 45 days after completion.

Utility Bills for a Manufacturing Plant:

A manufacturing business receives a $25,000 electricity bill, due in 20 days.

Are credit card purchases counted as accounts payable?

Accounts payable keeps a record of any purchase made by your business that you have not paid yet—which can include credit cards if you don’t immediately pay off the outstanding balance.

With a credit card, you likely won’t list every single purchase as an individual AP line item. Instead, you would list your statement balance for the credit card after the closing date. The statement balance is the combination of all of your purchases on the card from the previous month that will now need to be paid off on your upcoming payment date.

However, AP is not just purchases made with a credit card. It includes any short-term debt that you are not immediately paying for with cash (like the examples listed above).

Why is accounts payable important?

Tracking your accounts payable is a critical component to managing your cash flow.

As you run your business, you will spend money on different services and you will receive invoices that need to get paid. If you can’t manage your debts, you could find yourself burning through cash, or worse, defaulting on a debt.

Especially when you are growing quickly, you may need to buy more inventory and invest in business expansion at a faster rate than your customers are paying you. This means that you will have bills that come due before you receive money from your customers.

To stay on top of a situation like this, you need to keep track of your accounts payable and make sure that you have enough cash on hand to continue paying your bills.

Ideally, you should forecast your sales and cash flow to make sure that you plan to have enough cash to cover the costs of growth.

What’s better? Higher or lower accounts payable?

In general, having a lower accounts payable balance is better. This means that you are paying your bills on time, and aren’t risking getting into any trouble with your vendors and suppliers.

Of course, as your company grows, your accounts payable will also naturally grow as you purchase more supplies and have bigger bills to pay.

Don’t worry, though. This is totally normal.

How to reduce your accounts payable

If your accounts payable is increasing and you need help paying your bills, there are a few strategies you can explore to help reduce your AP or at least manage it better:

1. Negotiate with your suppliers

Most suppliers would rather see you pay their bills than have you default and not pay at all. A simple call to your vendors to negotiate a payment plan or an adjustment to payment terms can often help ease the pain.

Also, this method can keep you in good standing with your supplier so you can continue to do business with them.

2. Encourage your customers to pay faster

For most businesses, getting cash in the door from customers is the best way to help pay bills faster.

I covered a few ideas in my post on accounts receivable, so take a look at those and see what you can do to get your customers to pay you faster so you can pay your bills and reduce your accounts payable.

3. Establish a business line of credit

You should do this before you have an accounts payable problem as banks are less likely to lend to you if you already have too much debt.

If you do open a line of credit, that can help ease the pain of certain times of the month or year when you have less cash on hand than you normally do. Just be careful not to overextend your business and add even more debt.

Instead, think of a line of credit as a very temporary loan that allows you to pay your bills while you wait to get paid by your customers.

4. Lower your costs

This is probably the most obvious option for lowering your accounts payable, but it’s always worth mentioning. When you shop around for different vendors, you might be able to lower your expenses and therefore lower your bills.

It’s always good to be on the lookout for better deals for your business, so reserve some time every few months to look at your expenses and see where you might be able to cut costs.

Where to find accounts payable in LivePlan

There are a few key ways for you to manage and analyze your accounts payable using LivePlan’s cash flow forecasting and performance dashboard features.

Forecasting accounts payable

You can forecast accounts payable for future months within the Cash Flow Assumptions section of the Forecast builder.

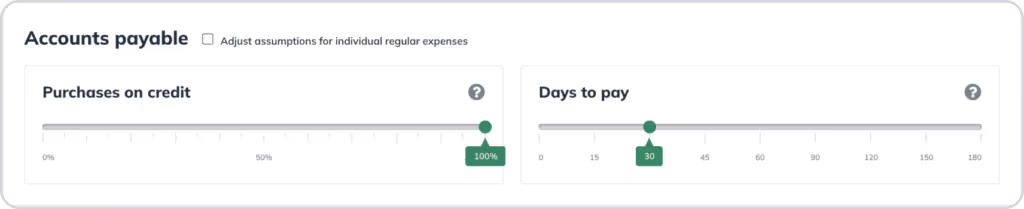

Here you can use the “purchases on credit” and “days to pay” sliders to indicate the percentage of your purchases you will make with credit and what the payment terms are.

If this method of forecasting is too general for you, you can adjust the payment terms for each expense instead.

Tracking accounts payable

Within your forecast, accounts payable will now be listed as a line item in your projected balance sheet. You can also see changes to accounts payable in your cash flow forecast.

If you sync your accounting data to LivePlan, you can visit your dashboard to review your current accounts payable balance and compare it to your forecasts as well as previous periods.

You can also explore the performance of your AP and your average days to pay by exploring the Trends tab in the Dashboard. This takes out the manual processes and calculations required to explore the impact of accounts payable on your business.

Visit our help center for more details on how to manage accounts payable and accounts receivable with LivePlan.

Track accounts payable to help manage cash flow

Tracking accounts payable is a critical component of managing your cash flow. You’ll want to know how much you owe and to whom.

With the right strategies for managing accounts payable, you’ll maintain a solid cash position which is crucial for any growing company.

However, AP is just one critical metric worth tracking as a business owner.

Check out my write-up explaining the key metrics I recommend tracking (and actively do here at LivePlan) to manage business health, identify potential problems, and ultimately grow your business.

FAQ

What’s the difference between accounts payable and accounts receivable (AR)?

The key difference is that accounts payable refers to what a business owes while accounts recievable refers to what is owed to the business. AP is also listed as a liability while AR is listed as an asset.

Is accounts payable a liability?

Yes, accounts payable is a liability because it represents the money a business owes to its suppliers for goods or services received on credit.

More in Planning

planning

I tried the “Deep Research” features in ChatGPT and Gemini. Here’s what I found.

planning

LivePlan vs Venturekit: Comprehensive Business Planning Software Comparison (2025)

planning

How to Plan for the Impact of Tariffs

planning