2021 State of Small Business Report — LivePlan Research Study

Jump to

In 2020, small business owners and entrepreneurs simultaneously faced a public health, economic, and management crisis. But through it all, they persevered. They found solutions and adapted to not just survive, but thrive.

We talk so much about adapting and pivoting, but what did businesses do in 2020? What are they doing now? And how will the impact of COVID-19 affect current and prospective small business owners this year?

To find out, the LivePlan team asked our community of small businesses and soon-to-be entrepreneurs to share how they’ve been impacted and their expectations for 2021.

Sample size and methodology

We reached out to our LivePlan readers and subscribers with a 40-question survey distributed through the LivePlan blog, email, and in-app messaging. 283 people across 27 different industries completed the survey.

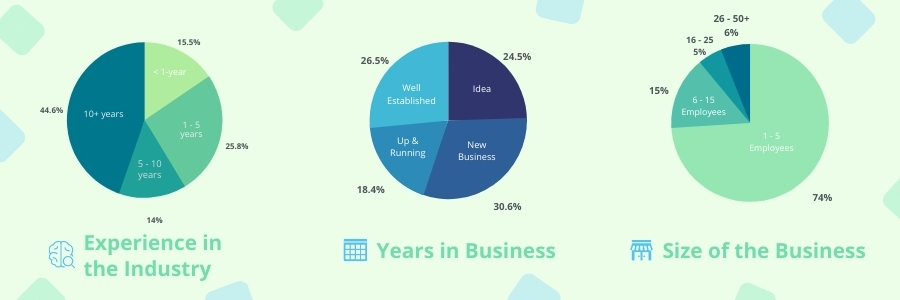

User breakdown:

Top 5 industries selected

- Business & Professional Services

- Food & Dining

- Arts, Entertainment & Recreation

- Health, Medicine & Social Assistance

- Agriculture, Forestry, Fishing & Hunting

Impact of COVID-19

Everyone has felt the effects of the coronavirus. Either directly or residually in the form of safety regulations, shutdowns, and other forms of economic disruption. And it’s likely no surprise that small businesses have experienced the brunt of it.

73% of respondents stated that their businesses were affected in some way by COVID-19.

Top negative effects

For those that stated they were negatively impacted by COVID-19, these are the top effects:

- More than 60% experienced a reduction in customer demand

- 42% had to delay launching their business while 39% had to make plan revisions

- 36% experienced temporary closures

- 27% had to make layoffs, furloughs, or pay cuts

Top positive effects

For those that stated they were positively impacted by COVID-19, these are the top changes:

- 67% saw an increase in demand

- 29% transitioned to working remotely and adapted their businesses to sell online

- 35% also had to rethink their business plan or idea

- 27% hired more full-time, part-time, or contract employees

For the 25% that found the impact to be negligent, they still experienced increases and decreases in demand, the need to transition to remote work, as well as delays and closures. In every case, it was far less impactful.

For example, only 5% (no obvious positive or negative impact) temporarily closed their businesses, while 36% (negative impact) temporarily closed their businesses.

Industry breakdown

eCommerce and digital services have been the shining stars throughout 2020. But what about other industries, how have they fared?

- The hardest hit by COVID-19 were Arts, Entertainment & Recreation, Food & Dining, and Agriculture

- Top growth were educational services, construction and contractors, and Health, Medicine & Social Assistance

- Mixed bag were industries, like Business & Professional Services, and Food & Dining displayed both dramatic growth and losses

Established businesses experienced a greater negative impact

Those that operate a well-established business (1-3+ years) are 16% more likely to have seen a negative impact compared to a new business (less than 1 year). In fact, established businesses fall much closer to the totals we listed above — with customer demand, workforce reduction, and temporary closures falling within 1-2 percentage points.

New or emerging businesses, on the other hand, fell 7% below the negative impact average. Reductions in customer demand, workforce, and temporary closures were far less common, with new businesses falling around 66% below the average. However, delays in launching a business did increase by 3%.

Maintaining sales, budgets, and forecasts were the primary challenges for those surveyed

While the impact may have been different depending on the industry and business stage, the difficulties that faced businesses were rather consistent.

- 56% struggled to maintain sales channels and balanced budgets

- 58% struggled with forecasting sales and expenses

These difficulties didn’t change no matter how you sliced the data. Even experienced small business owners or seasoned veterans in their field struggled with maintaining their business health and trying to make strategic decisions about the future.

Takeaways

Any business that was hit hard by COVID-19 experienced relatively similar struggles. Maintaining cash flow, stabilizing customer interest, and retaining their workforce were all prevalent issues that remained consistent no matter the business size or industry. And while we like to paint broad pictures of success with the likes of eCommerce and digital services, it’s difficult to mark clear industry winners or losers this year.

For example, restaurants and food trucks have been shown as businesses fighting on the front lines as they deal with closures, health regulations, layoffs, and diminished interest. Not to say that isn’t happening, but according to our respondents, more than 50% have seen a positive impact or no impact at all.

Taking that a bit further, we’d like to say there are some obvious reasons why some are succeeding while others are not. Maybe it has to do with the size of the business, or the experience of the owner. But even those factors don’t tend to influence the negative impact only the positive.

Larger businesses simply display the ability to take advantage of any positive traction. Similarly, newer businesses tend to have the ability to be more flexible than well-established organizations. The bottom line is that we can’t broadly base success or failure in 2020 on one singular factor. It has more to do with how businesses adapted to their current environment.

How small businesses adapted to survive

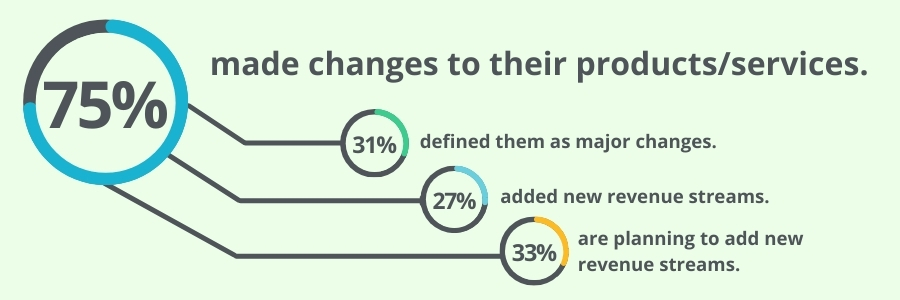

Businesses were anything but complacent when facing down an uncertain future. 75% of those surveyed stated that they made some changes to their products or services. For those that were negatively impacted, more than 80% made some sort of adjustment. But these changes were far more cautious, with only 22% noting them to be major changes and 44% as minor adjustments.

While only 65% of those in the neutral category made changes, they did make more dramatic adjustments. With 77% stating that changes made to their products or services were moderate or major.

The goal? Develop new streams of revenue

27% of those surveyed used those changes to develop new streams of revenue. In fact, those that experienced positive traction were 5% more likely to create an additional revenue stream. And those that were hit negatively by COVID-19 were 3% more likely to develop new streams of revenue.

Unsurprisingly, established businesses explored additional streams of revenue more than new businesses. 39% created additional revenue sources, with a positive impact once again driving more businesses to take this course of action. The real story here is how many businesses are planning on exploring new revenue options in 2021.

Over 33% of those surveyed plan on adding new resources of revenue this year. Again, those affected positively are 3% more likely to do so, but more new businesses (31%) are planning to explore their revenue options.

What was the impact of disaster relief funding?

We can’t talk about adapting to survive without covering disaster relief funding. We asked those surveyed their current application status for the Paycheck Protection Program (PPP), the Economic Injury Disaster Loan (EIDL), and local assistance programs. Here are the results:

- 56% applied for the PPP

- 54% applied for the EIDL

- 32% applied for local assistance programs

- 62% applied for multiple relief programs

For those that applied to the PPP or EIDL programs, only 49% actually received funding. The remaining 51% were either denied or received no communications regarding the status of their application. For those that did not receive funding, they stated that the primary reasons were:

- Their business had only been operating for a short time

- Poor personal or business credit history

- Missing loan documents

- Lack of thorough financial documentation

Takeaways

Small businesses did not stand idly by and hope for relief. They were active and making adjustments to their product and service offerings in order to expand the value of their businesses and potentially bring in new customers. It’s also likely that many businesses were attempting to solidify their relationships with customers they already have, especially if their product or service is considered to be nonessential.

Possibly the most interesting aspect is that those who were gaining positive traction were more likely to make drastic changes and develop new sources of revenue for their businesses. Yes, the negative impact of COVID-19, did drive more businesses to make changes, but they were typically minor. However, those that were already succeeding, were far more likely to take more drastic risks.

We don’t have specifics regarding what those changes actually were, but this does make sense. Those that were recovering needed to focus on saving their business first and then look for ways to adapt. While those that made changes early or experienced positive traction had already developed a cushion to make further adjustments.

Reliance on emergency funding

The last big takeaway here is that no one solely relied on the emerging COVID relief programs to save their businesses. In fact, only a little more than half applied to the core programs, and less than 50% of those that applied actually received funding. In many ways, that speaks to the lack of clarity and organization that these programs rolled out with.

But, those numbers may look drastically different with the slightly more refined process on the new round of PPP funds. Some businesses that didn’t get a response may hear that they now qualify, and those that were denied may get a second chance at funding. What’s important, is that most small businesses appear to have used relief funding as only part of their recovery effort. They found other ways to adapt without relying on one source of relief.

Expectations for 2021

As much as we’d like to leave 2020 squarely in the rearview mirror, the economic, societal and public health effects are stretching into this year. While that’s not the news we’d like to hear, small business owners are somewhat optimistic. Yes, the next month, 3-months, 6-months, is still very much unknown. But there is a certain level of experience of how to manage this crisis that business owners are looking to leverage this year.

So, to gauge actual expectations, we asked our survey participants what their expectations are for 2021, here’s what they had to say.

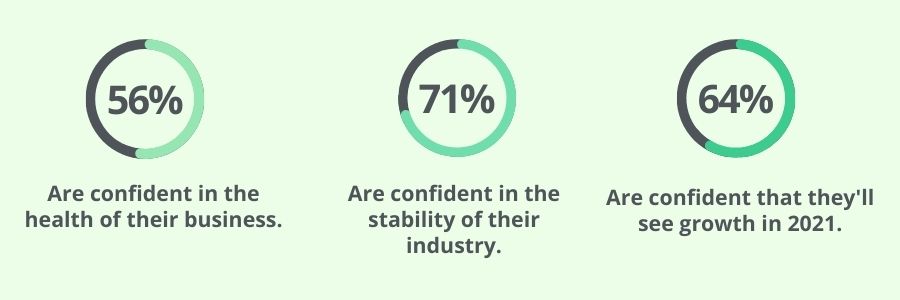

Confidence in their businesses

To establish a baseline we asked business owners what their confidence level is in regards to their business, the industries they operate in, and potential growth. The above graphic represents the percentage of individuals that marked their expectations as confident or very confident.

Most businesses find themselves cautiously optimistic. Only 18% are very confident and 16% are unconfident in their business health. For those that experienced positive traction in 2020, 83% are confident in the health of their business, 88% are confident in their industry and 79% are confident that they’ll grow this year. For those that experienced negative effects in 2020, the confidence level drops a few percentage points. 48% are confident in the health of their business, 67% in their industry and 54% are confident that they’ll grow this year.

Transitioning to remote work

While remote work became a hot topic, only 20% of those surveyed transitioned their team to work remotely. If they transitioned to remote work, the percentage of individuals confident in their business health jumps to 69%. 53% foresee this being a long-term change and 67% of new businesses are expecting it to remain as part of their business. However, the ability to work remotely does appear to depend on your industry:

Top industries embracing long-term remote work

- Health, Medicine and Social Assistance

- Information services and data processing

- Arts, entertainment, and recreation

- Business and Pro services

- Finance and Insurance

- Media and Communications

Top industries expecting to transition back to in-office work

- Agriculture

- Business and Professional Services

- Media and Communications

- Manufacturing

- Auto

- Community and Government

- Construction

Online selling

22% of those surveyed transitioned their business to selling online and 100% of them expect this to be a long-term process for their business. 54% of those that started selling online were relatively new businesses while 46% were well-established organizations. It appears that smaller businesses were able to make this transition more easily, with 77% being businesses with only 1-5 employees.

Here’s the industry breakdown of those surveyed that went through this transition:

- Business and Professional Services

- Educational Services

- Real Estate

- Finance

- Media

- Retail

- Arts and Entertainment

- Auto

- Computers

Planning is a priority

58% of businesses that feel confident in their business health have or are working on a business plan. 40% leveraged their plan to check the viability of their businesses and add additional revenue streams. 61% of those that conducted that viability analysis are confident in the health of their business.

Businesses didn’t use their plans in the exact same way, here’s why those surveyed developed or reworked their business plan:

- 39% reposition and find new strategies

- 36% revisit financials and check viability

- 25% to find customers

- 70% to create business

- 42% to attract investors

84% now plan to revisit their plans within the next 12-months. 42% plan to revisit it on a monthly basis, and 39% plan to update it even more frequently.

Takeaways

Unsurprisingly, 2021 is not serving as the clear break from last year’s crisis that we may have once expected it would be. For business owners, there is still uncertainty, that is now accompanied by a certain level of experience. Most are confident in the current state of their business and very few are actively concerned.

Perhaps even more encouraging is how many businesses are confident in the stability of their industries. Those higher expectations for the broader market seem to help bridge the gap for some owners regarding the health of their business. This may be one reason why more entrepreneurs are confident they’ll see growth this year, even if their current situation isn’t exactly stable.

For those in the US, it’s also worth mentioning that these results were collected before the finalization of the 2020 Presidential Election. It’s likely that a change in administration will impact confidence for business owners in some way. Hopefully, it will be positive based on divergent policies, but that is yet to be seen.

The future of small business

Remote work may not have been adopted by everyone, and for some industries and positions, it’s simply impossible, but it did have a positive impact on those that did. Owners were more confident, retained employees, and over half expect it to be a long-term part of their business. Even those that do intend to go back to a physical storefront or office, may still leverage remote work, but not embrace a full transition.

The same can be said about selling online. While a small fraction actually did it, the fact that every individual that did intends to utilize online sales moving forward shows how useful it can be. Again, not every business is capable or desires to do more online, but this recent crisis has only accelerated its adoption by customers and employers.

The core focus for businesses in 2021

Planning and regular reviews grew into a necessity throughout last year. While early on in the crisis the focus was squarely on finding ways to improve cash flow and stabilize sales funnels, it transitioned to a need to forecast and plan for future profitability. Many intend to continue this process, at least once within the next 12-months, and just under half intend to do it on a monthly basis.

During the crisis, the actual use of these plan reviews varied from identifying new streams of revenue to preparing loan applications. Moving forward, business owners hope to use their plans and financial documentation to become more proficient in the following areas:

- Updating or pivoting their business model

- Forecasting and scenario planning

- Marketing and research in this new climate

- Maintaining and improving cash flow

That may be the biggest takeaway from those surveyed. The desire to become experts. Not just in their given industry, but in strategically operating and analyzing business performance. Understanding the ins and outs of their financials and being able to correlate them with internal and external factors.

It’s a skill that helps minimize risk while providing greater certainty and direction, which is gravely missing in such a volatile environment.

Where to learn?

Understanding these crucial business topics takes time and the right resources. It can be difficult to know where to look and which educational material is worth subscribing to. So, the last thing we want to leave you with is the sites our survey respondents currently use to better understand core business topics:

- (40%) Small Business Association (SBA): As much an educational hub as it is a resource center, the SBA is built around helping small business owners succeed. You’ll find guides, loan documentation, local assistance programs, and plenty of other resources to help guide your business.

- (36%) LivePlan Blog: Yes, our survey respondents may be a bit biased, but it is our goal to cover current small business trends and provide tips, guides, and up-to-date resources to help you grow a better and smarter business.

- (35%) Entrepreneur: If you’re looking for insights from current small business owners, CEO’s and noted professionals, Entrepreneur has you covered. These are typically short, bite-sized articles covering everything from consumer behavior to broad market trends.

- (32%) Forbes: A broader news site that covers current events, trends, and business practices. Expect thoughtful pieces from industry experts, but also be wary of when they were posted, as some articles covering consistently changing topics (such as eCommerce and social media) can be upwards of 10 years out of date.

- (28%) Harvard Business Review: Well-researched and thoughtful articles fill out HBR’s library of resources. From tips and guides written by leading experts to educational case studies, HBR is best suited for doing a deep dive on a given topic.

- (27%) Bplans: For those just starting their business, Bplans is worth checking out. You’ll find expertly crafted templates, guides, and tips to help turn your idea into a successful business. And every resource is 100% free.

- (17%) Hubspot Blog: Hubspot covers a wide range of business topics, but the most valuable are their insights around sales and marketing. You’ll find up-to-date research, guides, and templates to help kickstart your own digital marketing efforts.

It’s also worth noting that more and more businesses are turning to live webinars and videos to research business topics. Articles came in close behind, and podcasts are slowly on the rise, but our respondents found live training and visual walkthroughs to be most helpful. Luckily, almost all of the sites mentioned above have some sort of additional educational material outside of articles that you can look into.

Keeping up with the state of small business

We hope you’ve found the insights in our 2021 State of Small Business Report to be useful in guiding your own business. Be sure to subscribe to the LivePlan Newsletter to be notified when we release more detailed coverage from our survey results in the coming months, as well as opportunities to participate in our next State of Small Business survey.

More in Managing

managing

Control Your Stress, Efficiency, and Intelligence in 10 Minutes a Day

managing

5 Ways Small Business Owners Can Save on Healthcare Finances

managing

The Top 10 Cash Flow Problems (and How to Avoid Them)

managing