Growth Planning: What It Is & Why It’s Essential in 2024

Posted By

It was the fall of 2008 and the financial world was falling apart. The “great recession” was just beginning. As companies failed and entire industries teetered on the brink of collapse, some sales channels at our small company dried up.

My wife and I had recently taken over Palo Alto Software (the creators of LivePlan). We were still getting our feet under us as we worked frantically to find the right strategy that would get our company through the recession.

During this time, we developed and refined the business planning process that kept our company alive. It helped us survive without any layoffs, and we came out of the recession as a stronger, healthier company primed for growth.

We knew that we couldn’t keep this growth planning process to ourselves—so LivePlan was built to make it easy for anyone to implement.

Now, growth planning isn’t just for existing companies like ours. It’s even more useful for new startups and small businesses that are risking everything to get up and running.

So, do you want to spend less time planning and more time growing your business? Let’s walk through the growth planning process and teach you how to make it work for your specific needs. No business or financial expertise required.

What is growth planning?

Growth planning is an ongoing business planning process that helps keep you focused, grow faster and adjust quickly to change. It prepares you to build a better business, not just a single business plan document.

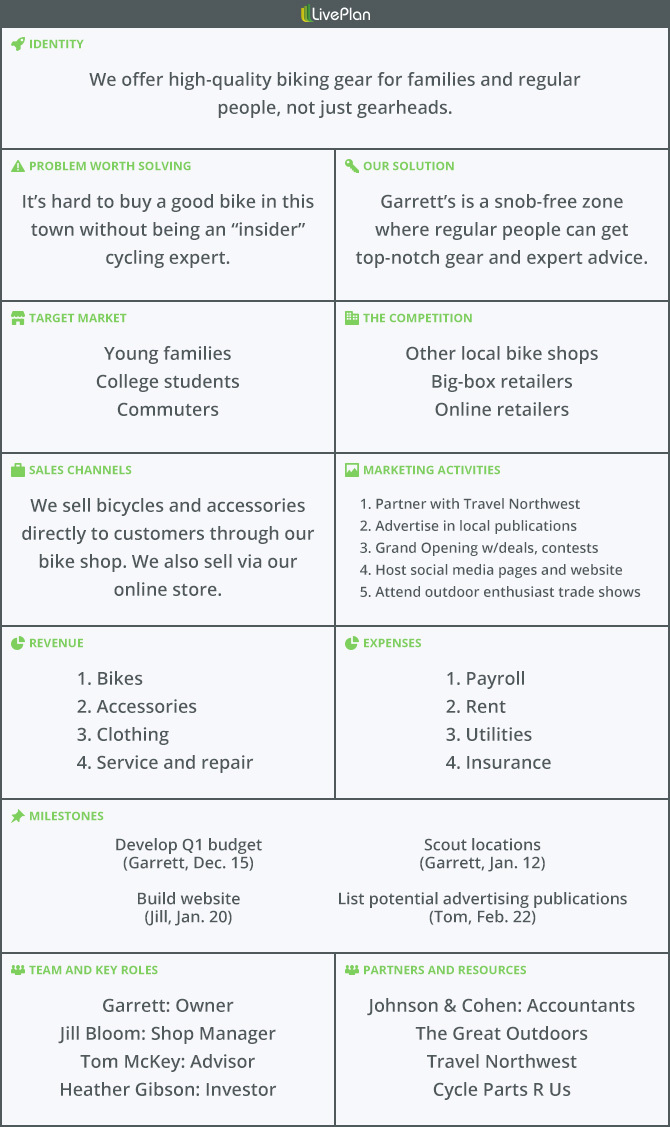

It all starts with a simple, one-page business plan—which you can download and create with this completely free template.

From there, you can use growth planning to clarify ideas, set solid strategic goals, track financial performance, and refine your strategy as you learn more about your customers and their needs.

Here’s a quick overview of the four-step growth planning process:

- Create a plan: Quickly size up the potential of your idea, validate that it can be a real business, and set goals to make it work.

- Build your forecast: Develop an expense budget and financial projections to better understand where your business is now and where it is headed.

- Review the results: Compare your forecast against your actual sales and expenses each month to stay accountable and uncover new ideas.

- Refine your strategy: Adjust your business plan and forecast based on your learnings.

How is growth planning different from traditional business planning?

Traditional business planning is a chore for small business owners. For decades, it meant writing a monstrous 40+ page document that required hours of research, numerous revisions, and monotonous number crunching.

And yet, some companies continue to hold onto this outdated concept.

“It has become deeply institutionalized,” reads one Inc.com article about the history of business planning. “In recent decades, accelerating change has made it even more difficult to accurately predict what will happen six months out, much less a year out.

Traditional plans take too long to write, the data is almost immediately obsolete, and they often aren’t useful in day-to-day operations. They simply don’t provide the flexibility needed to adapt to today’s fast-changing world. In response, experts have come up with some alternatives.

In the late 2000s, Swiss business theorist Alexander Osterwalder developed the Business Model Canvas. It’s a faster and more visual alternative to formal business planning, but it introduces its own set of problems.

That’s why we developed growth planning. It’s an even simpler way to produce the business plan documents and pitch presentations that you might need to successfully start your business, raise money, or get a loan. Any entrepreneur can do it — regardless of their background, education level or how established their business is.

But, the goal of growth planning isn’t to just produce documents that you use once and shelve. Instead, it helps you build a healthier company that will outlast all the business failure statistics.

We like growth planning because

- It’s faster than traditional business planning. You can complete an initial one-page plan that covers all of the necessary details about your business in just 30 minutes.

- You can revise your plan and strategy in minutes instead of hours. This means that your plan stays up-to-date and useful for identifying potential problems and opportunities.

- It’s concise. Because growth planning requires you to document your ideas with limited text, your ideas are distilled to their core essence.

So, how exactly do you start growth planning? Let’s look at the four key steps you’ll be using to create a business growth strategy that helps you achieve your goals.

Step 1: Create a one-page business plan

The one-page plan format is essentially a one-page summary of your business concept. Think of it as your virtual bar napkin where you’re jotting down ideas about your business. Unlike a napkin, it’s easy to change and revise things as you go (and it lacks those pesky ketchup stains).

For your one-page plan to work, you’ll need to cover:

- Strategy: what you’re going to do

- Tactics: how you’re going to do it

- Schedule: who is doing what and when

- Business model: how you will make money

Addressing these four key aspects of your business helps explain what you’re going to do and how you’re going to do it. It’s great because you can easily share this with business partners and even investors to give them a summary of your business.

Your one-page plan can also be used as the foundation for a more detailed business plan document. But, for many entrepreneurs, a one-page plan might be all the planning you need to do, and you’ll be able to skip the entire detailed business plan.

Download our free one-page plan template and get started right away. LivePlan also includes a one-page plan, plus full financial forecasting, so you can use that if you’re looking for an online tool that includes more features than a downloadable template. For more detailed instructions, read our step-by-step guide for creating your one-page business plan.

For startups, use your one-page plan to test and validate your idea

Reducing risk is one of the most important benefits of early growth planning. Instead of rushing out to start your business, take the time to make sure you have a good idea and that you’ll be able to create a viable business. Most businesses that fail skip this critical step.

When developing your idea using the one-page plan framework, you write down all of your key business assumptions. These are your best guesses about who your target market (customers) will be, the problems they have, and how your business will help them.

Now it’s time to find out if your assumptions are true:

- Do your potential customers have the problem you think they have?

- What do your potential customers think of your solution?

- What’s the best way to sell to your potential customers?

- What marketing tactics will work?

There’s no better way to answer these questions than to actually talk to potential customers about your product or service. Find out how much they’re willing to pay, what competing products or services they currently use, etc.

If you need help figuring out how to talk to customers, check out this guide.

As part of this research, you may discover the need to refine your solution, or even reconsider the problem that you are solving. Since you haven’t created a detailed business plan at this point, you can easily adjust your one-page plan. The key to testing your idea is to constantly go back and revise it as you learn.

Even without moving past step one, you’re already practicing growth planning by circling back on your idea, testing its potential, and making strategic adjustments. Not only will you be better prepared to run a more profitable business, but you’ll avoid starting something that just won’t work altogether.

What if you need a more detailed business plan?

You may have a “business plan event.” A potential investor asks to see a more detailed business plan. A loan officer requires a detailed plan alongside your loan application. Maybe you just want a detailed 10-page document to hand to your team that easily explains your strategy.

If that’s the case, use your one-page plan as a starting point and add the information needed to make it useful for your business needs. Don’t write paragraphs and paragraphs of text. Try to still keep things as short and concise as possible.

Thankfully, you’ve already done the hard work of developing your business strategy. You’re just expanding on it with additional details on your marketing, sales, products, etc. You can check out our full guide on creating a detailed business plan document to learn exactly what to include.

Step 2: Build your forecast

The next step in the growth planning process is to build a financial forecast. This will help you set revenue goals, define expense budgets, and understand how cash moves in and out of your business.

If you’re a startup, you don’t need to build out incredibly detailed spreadsheets. Just take broad strokes to get a rough idea of what it will take to make your business successful and if it even makes financial sense to start a business.

If you run an existing business, you may already have these financial forecasts. But, if you don’t, now is the time to set your sales goals and create a budget for your expenses.

For this step, you will create:

- A sales forecast

- An expense budget

- A cash flow forecast

Building a sales forecast

For your sales forecast, think about how many products, hours, or meals that you might be able to sell in a given month and what each customer will pay on average. Then think about what it costs you to make and sell your product (your “cost of goods sold”). For detailed advice, check out our guide on building a sales forecast.

Budget for expenses

With a rough sales forecast in place, you can now think about your expenses. This includes rent, insurance, marketing, payroll, and other costs of running your business. Create a list of these expenses and then compare the costs of running your business to your forecasted sales.

This will tell you if you can run a profitable business based on your best initial guesses. Sales need to be greater than expenses, if not from day one, at least eventually.

You’ll almost certainly need to refine your numbers after your first pass. But this is still a worthwhile exercise to figure out if the business actually makes sense and can make money. Check out this guide for more details on creating an expense budget and calculating profitability.

Forecast cash flow

Finally, and most importantly, you’ll want to look at your projected cash flow. Your cash flow forecast will help determine how much money you need to raise to get your business off the ground and fund your growth. This is especially useful for companies that sell “on credit,” where customers don’t pay right away, as well as companies that carry inventory.

Unlike a profit and loss forecast, a cash flow forecast is all about tracking the timing of when cash moves into and out of your business. That’s because cash and profits are different.

For example, your profit and loss will show when sales get made, while your cash flow will show when you actually get paid. For any business that doesn’t get paid right away, this is very important.

To build a cash flow forecast, you’ll show all of the cash you expect to receive and subtract all of the cash you plan to spend. If the number is positive, you have “positive cash flow” and your bank account will be growing. If you have “negative cash flow”, your bank account is shrinking.

The real benefit of a cash flow forecast is that it can help you predict the amount of cash you will have in the bank. Knowing when you might run short on cash will help you determine the best types of loans and investments, and when you need them, to build your business.

Now, you could put all of these forecasts together with Excel, but I recommend checking out LivePlan. It will help you quickly produce all of the financial forecasts you need without complicated spreadsheets and immediately embeds your forecasts within the growth planning process.

Step 3: Review your results

Growth planning is all about steering your business toward smarter and more strategic action. To do this, you’ll track your actual financial performance and compare it to your plan to determine if your business strategy is working.

Tracking your performance is a simple process. At a minimum, you’ll review your actual sales and compare them to your sales forecast. Review your spending and see if you’re staying on budget.

Beyond sales and expenses, you may want to track other metrics to ensure that you’re on the right track. This fully depends on the type of business you are running.

The most effective way to do this is with a monthly plan review meeting. Setting a time for review ensures that you’ll actually prioritize stepping away from the day-to-day to zoom out and look at your business as a whole. By putting the meeting on your calendar, and ideally, including others, it becomes a can’t miss commitment.

Tracking your performance is arguably the most important step when growth planning. Without tracking the key metrics for your business, you won’t know if things are going well or going poorly. Spotting trends early and making adjustments to your strategy and tactics is critical to business success.

Don’t beat yourself up if you aren’t meeting or beating your plan. The goal of tracking your performance is not to “stay on plan” but to make adjustments if things aren’t going “to” plan.

Step 4: Refine your strategy

So far, you’ve created a one-page plan for your business, built a forecast, and are now tracking and reviewing your results against your plan. Now it’s time to take action and refine your strategy and your forecast—but only if you need to.

Based on the results of your review that you completed in step 3, you may need to refine your plan. Don’t feel like this is a requirement every month, though. You should only refine your plan if your strategy either isn’t working OR things are going much better than you had originally planned. If you’re meeting your expectations, staying the course might be the best bet.

When you review your actual results against your plan, look for problems and opportunities. If sales aren’t meeting expectations, think about your marketing and sales strategies and if you should refine those. Maybe you should adjust your spending and refine your expense budget moving forward.

On the other hand, maybe part of your business is doing better than expected. You might want to consider focusing more on that part of the business or using excess revenue in one area to fund development or marketing in another area.

While refining your strategy, take the time to explore different financial scenarios to see how each decision could impact your business. For example, you can experiment with alternative expansion or hiring plans to better understand the impact on your cash and profitability over the next several months.

Refining your plan and your strategy is the final step in growth planning before you begin the cycle again. Successful business owners use growth planning to understand the health of their business and guide it toward ongoing growth and stability.

Harness the power of business growth planning

I hope you found this guide to growth planning useful. The growth planning process has been instrumental in growing our business and I hope it will do the same for yours as well.

Not only do we practice growth planning as a company, but our LivePlan product is built to make it easy. We use LivePlan to manage our growth planning process and are constantly refining it to make it even better for your business as well as ours.